DISCO Corporation, The World Leader In Semiconductor Capital Equipment For Cutting, Grinding, Polishing

Unique and differentiated company culture for an exceptional semicap firm

DISCO (6146) is a Japanese firm whose core competency is grinding the wafers semiconductors are manufactured on thinner and cutting them into die which can then be assembled into electronics. Their company motto is Kiru, Kezuru, Migaku which means cutting, grinding, and polishing. DISCO holds leading market share in the production of wafer grinders, grinding wheels, wafer dicing saws, laser saws, and surface planarization.

These businesses allowed DISCO to generate nearly $2B of revenue in 2021. We will be diving into the major semiconductor process tools DISCO makes as well as what we think about the stock and our forward estimates of their earnings and market share. They are a very atypical company in the industry that we believe deserves a deeper look by both investors and enthusiasts of the industry.

Before we dive into those topics, let’s briefly talk about the history of the firm as well as their unique culture. Before the days of being laser focused on semiconductors, DISCO was called Dai-Ichi Seitosho CO. They only renamed themselves once they started exporting to the United States for ease of pronunciation. They were focused grinding wheels for a variety of products, but they really hit their mark when they produced a thin (1.2mm) high precision blade used for grinding C shaped magnets. As they progressed, they invented the resinoid blade which encapsulated a hard material inside an ultra thin (0.13mm) resin. These were used to slit fountain pen nibs.

DISCO continued to make thinner and thinner grinding wheels, with the MICRON-CUT, a 40 micron thick wheel. Many equipment makers and industrial firms began to blame DISCO for damage because tools were not adapted to be able to accept these ultra-thin grinding wheels. Because of this, DISCO began to design their own equipment. DISCO tools were even used to perform the cutting of moon rocks brought back by Apollo 11!

In the 70’s DISCO jumped onto the semiconductor industry by producing an automated scriber and dicing saw. At the 1977 Semicon conference, DISCO developed and was showing off their DAD-2H dicing saw. They had issues with the dicing wheels breaking when stopping and restarting the saw, so the DISCO team decided to make their saw and dicing wheel never turn off during the entire multi-day long show. Apparently, this was all the rage among semiconductor nerds at the show in 1977. Here’s a link to that product’s manual for semiconductor nerds in 2022.

Despite being an old Japanese company, the company culture is nothing like that. They are ruthlessly efficient, and laser focused on quality and throughput. They may have the most unique corporate culture in the world. Let’s talk about how it came about.

DISCO faced problems that many large and old corporations have faced. Mountains of time ends up being wasted in meetings upon meetings. Dozens of employees must be involved in every decision. There is no room for innovation and employees waste loads of time on unnecessary actions. Bureaucracy kills the lifeblood of the company. At the same time, there is poor communication across the organization as employees become more and more specialized in their niche that they miss the overarching strategy. There are too many layers between those working on specific details of products and management.

The solution is very bizarre and frankly cool. There is an internal virtual currency created called “Will”. This currency is used as a compensation system to track how much each person and team contributes to earnings. Workers receive a base salary and a bonus which is determined based on how much Will they earned for completing tasks. Groups pay each other to complete tasks. Sales teams pay factory workers to produce goods, who in turn pay engineers to design products. Once a sale is made, it generates a certain amount of Will that trickles through to everyone in the supply chain, including human resources and IT support staff.

Rank and file employees earn the virtual Will currency when group bosses allocate a portion of the group’s Will budget to each task they must complete. Team members then use an app to bid in an auction for those jobs. Assignments that don’t attract any bids often turn out to be unnecessary work. Managers who’ve misused or abused the system have been abandoned by their workers, who are free to move to other teams.

At DISCO, everything has a price, from conference rooms, office desks, and PCs to a spot for your wet umbrella. Individuals almost operate as one-person startups!

We’ve created a free economic zone, just like what exists outside the company, work should be about freedom, not orders.

Toshio Naito – DISCO program designer

The freedom enables employees to shape their own day to focus on the value placed on their own time and efforts. The ruthlessness of a hardcore free-market approach is diluted in a setting where people work side-by-side.

There’s a penalty system for inefficient behavior, which includes piling up unnecessary inventory or even working late. Overtime hours have fallen 9% since penalties were implemented in 2015, aligning with the Japanese government’s goal to improve work-life balance

Economic forces are doing all the things managers used to spend time on. Employees can earn extra Will by helping each other: A parent who wants to see a kid’s baseball game can pay a colleague in the currency to finish a report. A software engineer can earn extra by offering coding skills to another team. Creating Excel macros or translation work are typical requests.

Toshio Naito – DISCO program designer

The success of this program can’t be understated. DISCO went from a 16% operating margin before it was implemented to a 36% operating margin in the most recent year. Furthermore, they have gained some share as well.

DISCO products are used through the entire process of manufacturing chips. Ingots are grown and cut then grinded down. The backside of a wafer is grinded down before the wafer is diced. The wafer is diced, and chips are packaged on large format packages which cut to produce individual units. There is a lot more complexity at each of these steps.

Also apologies in advanced for some of the next pictures, we took them with our cellphone at SemiCon. With that said, the fine text is still legible, so we know some of our readers will appreciate that.

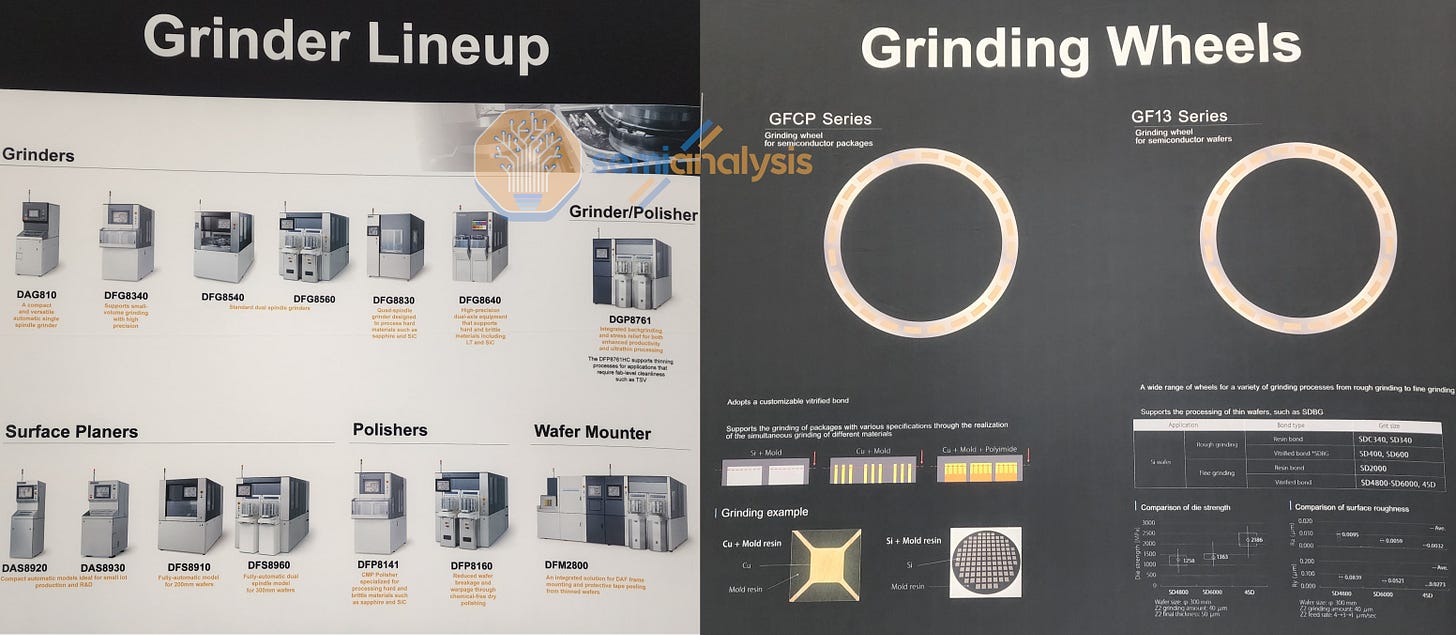

The grinder lineup varies quite a bit based on throughput on silicon wafers. There are also different tools for exotic materials such as silicon carbide which are harder than diamonds. The material handling is incredibly important depending on the thickness of each. Unfortunately, DISCO doesn’t have many videos of their products, but here is a video of one of their mid-range grinders in action from FabSurplus, a used equipment refurbisher and reseller. After the main grind, some use cases demand the use of a grinder/polisher to make the surface more uniform. Additionally, there are surface planerers. They use commonly use a diamond bit to partially remove a portion of the wafer. DISCO also sells CMP tools, but they have very low share compared to Applied Materials with majority share and EBARA with most the remaining market.

The market for thinning applications is soaring as advanced packaging takes off, especially hybrid bonding.

The dicing saws and blades are the other bread and butter business for DISCO. There are again a variety of tools based on the level of automation and throughput required. There’s also a huge variety of blade types. We won’t dive into it, but we did love the opportunity to speak with DISCO about all the types and their various use cases. In general, there are 4 main types of blades that sit along various points in the curve for rigidity vs blade lifetime vs cutting ability. Saws, just like grinding wheels, wear out and must be replaced at a semi-regular interval. It’s a good consumables business for DISCO.

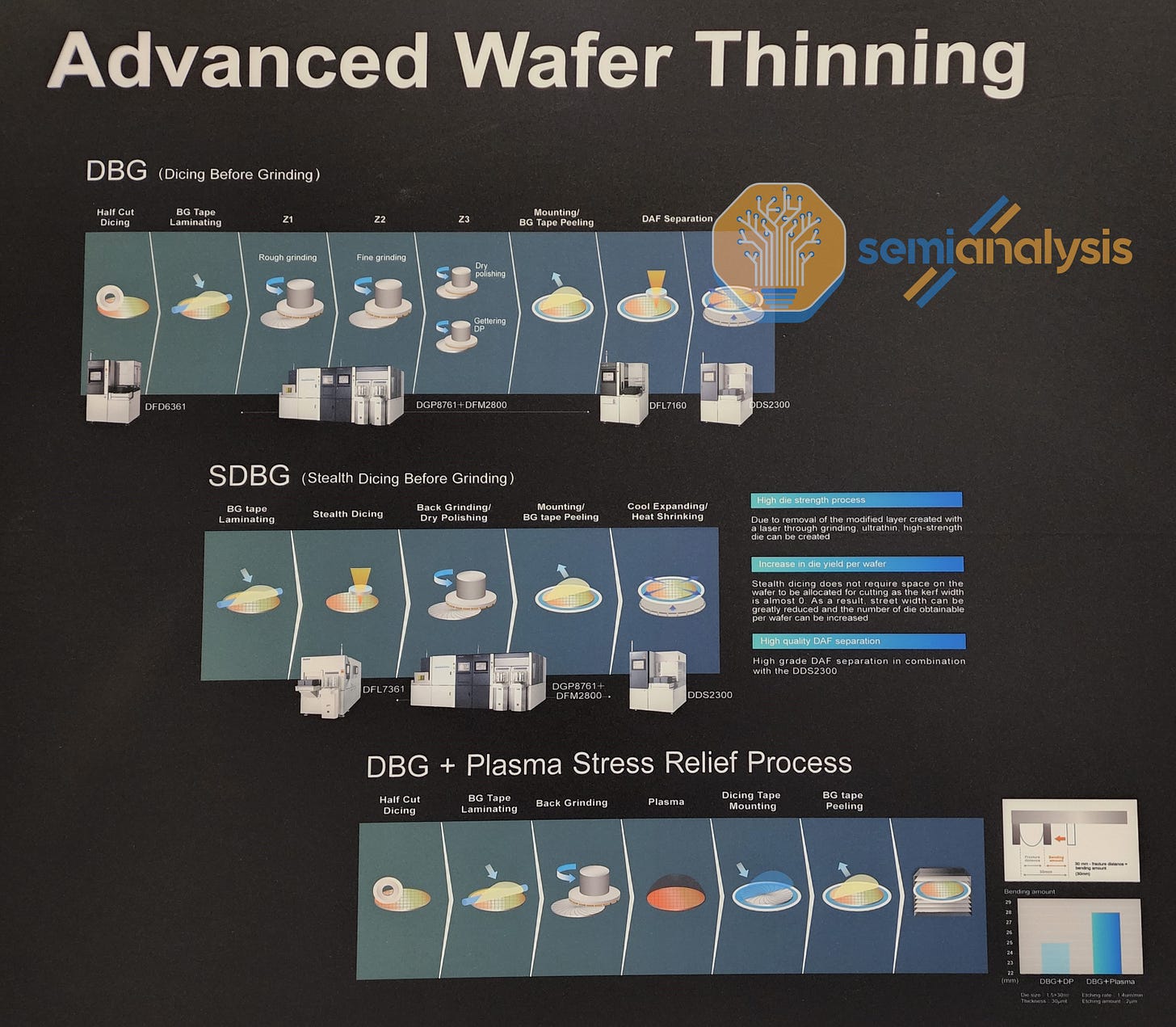

In many cases you don’t just grind then saw with a physical blade. Here is a slide that showcases some advanced thinning techniques. Dicing before grinding is quite common. This video showcases it visually, but the wafer is cut through partially before it is flipped and grinded through. As the grind through occurs, it meets the partial cut and the wafer breaks apart into dies. This process encompasses a lifecycle of 5 DISCO tools + multiple consumables such as the saws, grinding wheels, and tape laminates.

Dicing isn’t only done with saws. It can also be done with lasers. This is called stealth dicing. Here is where we will introduce the concept of a “street.” The street is the area between dies. As the die sizes get smaller, the street takes a disproportionately larger area of the processed silicon wafer. Ultra-small die sizes have to contend with the street eating into the cost budget. As such, saws become very inefficient. This is where stealth dicing comes in. The laser can deal with streets that are almost 0 in size. There will be some wastage, but the width is greatly reduced and so the number of dies per wafer can be increased.

Stealth and plasma dicing is currently mostly used on specialty processes, especially MEMS, or with extremely small die sizes. As wafer costs soar with upcoming 3nm nodes and advanced packaging takes hold, we could see stealth dicing make its way into leading edge logic chips. The laser generally focuses on a portion of the wafer underneath the top layer. Here is a video of the multi-step process. It can also be used to groove the wafer then cut through with a plasma. There are some concerns about bringing laser dicing to other processes because lasers can cause delamination and issues related to streets with metals in them. Saws have other issues where cutting the chip could result in damage as metal is dragged into the street.

The Taiko process is a very interesting innovation. Rather than grinding the entire wafer then having to use a temporary carrier for structural support, the grinding wheel only grinds the inner part, leaving an outer ring at full thickness. There are some etch processes for stress relief. Afterwards there is advanced integration of vias, bumps, discrete devices, backside metallization, and wafer level probe card testing. The full thickness ring is cut off with a laser and the final assembly is cut into dies meant for packaging.

The laser lift-off tool looks incredibly similar what SOITEC is doing with their Smart Cut SiC technology in principle. The laser lift-off is shown on a sapphire substrate, but the transfer of a separate epi layer is similar. It could be that SOITEC is using the tools from DISCO, but they make no mention of lasers for lift-off in their PR.

DISCO has a near lockdown on the power semi market in general due to the grinding and cutting being more complicated here vs silicon.

We will talk about some of DISCO’s competition, structural shifts in the industry, and our estimates on forward earnings, and what we think about the stock in the subscriber only section.