Intel Roadmap and PC TAM Update – Tone Deaf, Out Of Touch, Living In a Fantasy World, or Disconnected From Reality?

Intel held their PC TAM (total addressable market) and Roadmap Update event online yesterday. It drew some major question marks. Frankly, the whole thing was just bizarre…….

This report will walk through the oddities of this presentation, how out of touch some of Intel’s executives are with the market and general consumer, the roadmap update including exclusive Lunar Lake details, AI’s infusion into client SOCs, and some of the Arm vs. x86 Intel vs. x86 AMD market share figures.

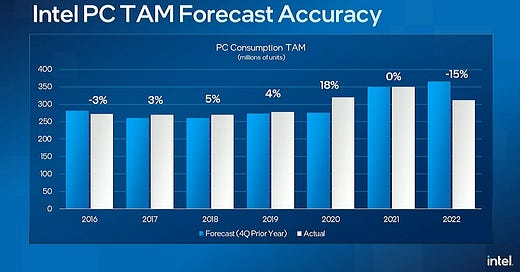

The event started with Intel bragging about how accurate their market intelligence and forecasting teams are.

Our team at Intel has a strong history of accurately forecasting Intel's PC TAM. In fact, over the past 7 years, our forecast have had accuracy within plus/minus 5% with 2 exceptions.

Christoph Schell, Chief Commercial Officer

Congrats?

Do you want a cookie?

The sad thing is that Intel’s forecasting is not good. In fact, for most of the pre-covid years, it would have just been more accurate to take the prior year’s sales figures and plug them into the following year’s model.

Of course, every company has a free pass for inaccurately estimating 2020 because forecasting a global pandemic is impossible.

2022 is where some criticism could come in. Management teams should refrain from building hyper-aggressive unit estimates into their financial models. It makes them untrustworthy.

2022, as we all know, was an unprecedented year as no one predicted the war in Ukraine, the significant inflationary pressures, the continued COVID driving weakness, particularly in China, and all of that resulting in a deteriorating macroeconomic environment, leading to the risk of a global recession.

Christoph Schell, Chief Commercial Officer

The war in Ukraine was definitely unexpected, but inflationary pressures and a weakening macroeconomy were not crazy takes to have in Q4 2021, yet Intel gave that as an excuse for why they missed

Even SemiAnalysis published about these issues as early as Q3 2021, and we are by no means macroeconomic analysts.

We completely understand companies’ missing their 2022 forecast. Everyone missed it for the most part, but don’t brag about it, especially when your miss was among the largest in the semiconductor industry……

AMD, for example, projected “down high single digits,” which was far more accurate.

In June, we were one of the first companies to highlight an abrupt and pronounced slowdown in demand, which broadened beyond initial expectations and had an industry-wide impact across the electronics supply chain. As a result, we experienced a decline in the PC TAM in '22, and it was characterized by broadening consumer and education weakness that then also started to impact our commercial and enterprise demand.

Christoph Schell, Chief Commercial Officer

This was yet another odd place to brag. Much of the industry was expecting minus ~10% for 2022, roughly 300 million units, and Intel was predicting 350 million units. They said this new demand was permanent. Intel stuffed the channels, and they had to stop when demand slowed. The channel has way too much PC inventory. As a percentage of the size of the market, it’s even higher than the smartphone oversupply.

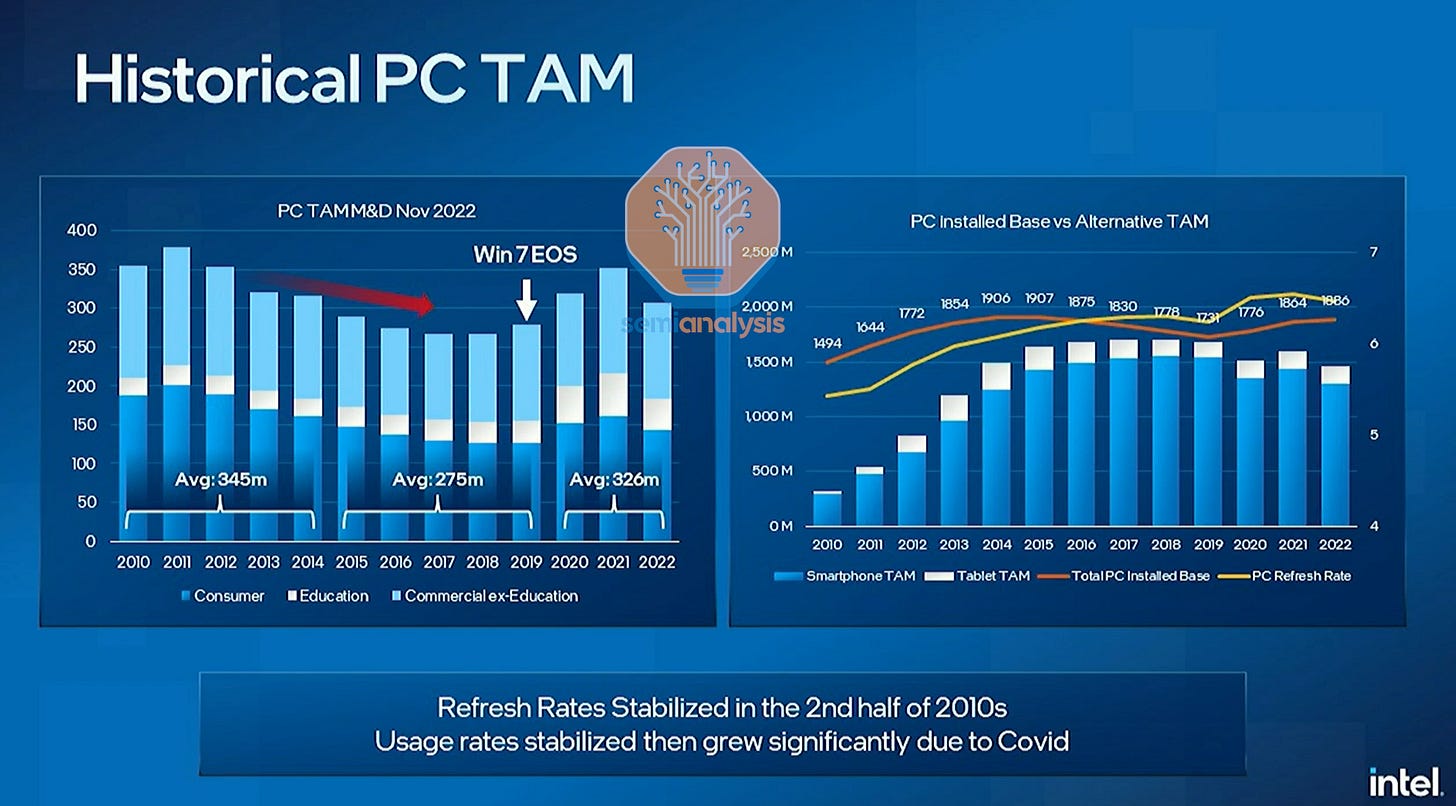

The historical figures show an interesting breakdown, particularly regarding the various eras of computing. In the 2010s, refresh rates lengthened at an incredible pace, leading to significantly fewer PC sales. Furthermore, the total installed base of PCs shrank as more basic tasks such as banking, payments, and emailing could be done on low-end smartphones in the developing world. Of course, smartphones are not a substitute for a PC, so that is not a trend that should stick around forever.

A simple TAM formula for all of you to remember is installed base divided by refresh rate plus new users. Internally, we split new users in 2 categories: increased density, additional PCs in the home or business; and increases in penetration, i.e., new households.

Both variables are impacted by many factors in the near-term environment. These are variables like inflation, GDP, technology developments, and given the importance of the PC TAM to Intel and our business, a lot of work goes into our modeling, and we have a dedicated team working this.

Christoph Schell, Chief Commercial Officer

Generally, there are a few growth vectors. In the west, we are entirely focused on the increased density of PCs per household. Growth comes from families having more PCs per household, whether for work, school, or personal use.

The other important vertical is PC use in the developing parts of the world, particularly Asia, Africa, and Latin America. The number of PCs per person there is much lower, and the use of smartphones for basic computing is required to be much higher. People in these parts of the world will graduate to having PCs for work, education, and leisure eventually.

Intel projects long-term PC TAM to be 300 million annual units. This is hard to stomach for many people, given that PC lifecycles continue to lengthen due to the lack of new applications that would cause an upgrade cycle beyond the Covid upgrade cycle. Most users only use basic office applications, video calls, and web browsers. Intel is assuming a 6.5-year replacement cycle, but multi-core laptops with an SSD and >=8GB RAM with an SSD should be fine for the vast majority of users for much longer.

PC units declined until Covid, bottoming out at ~260 million units. With the massive pull forward of upgrades during covid, there is a tremendous likelihood that PCs don’t hit 300 million units. Of course, we don’t discount the possibility entirely.

We do discount Intel’s estimate of 270 million to 295 million units in 2023.

This is absurd.

PCs sales are incredibly weak based on alternative data from one of our fund clients. Unit volumes for PCs this year are expected to be in the ~257 million to ~272 million range based on various street estimates. That range is based on a wide number of estimates, so Intel’s PC TAM is hard to believe.

When Intel shares its full-year guidance for 2023 later this month, we will be highly skeptical if it is based on their PC TAM estimates.

Long term, we aren’t even that negative about PC TAM, just 2023. PC units may touch 300 million again, especially when Windows 10 reaches EOL support. We fully believe 2024 sales will be above the 260 million unit trough of pre-covid.

The problem is that Intel is hosting a special investor event to defend its narrative of 300 million PC units.

I think we can argue 300 million plus/minus. All I want to get across is our point of view and have a debate with you on this, but it's really about we believe we're in a growth business, and we're in a growth category.

Christoph Schell, Chief Commercial Officer

Are these executives SO SCARED of rattling the stock price that they'll go so hard on the bullshit to try and avoid even suggesting a potential TAM drop?

Everyone must be wearing ballet shoes because they're walking around on tiptoes.

The consumer TAM slides shared some interesting data about PC usage versus before covid.

It surprised us to hear this bit about the commercial PC market from Intel.

On the commercial side, we've observed a steady refresh rate of 5 years, and we didn't see COVID drive a big change in the installed base versus TAM, as we observed for the consumer segment. Economic growth and the business cycle dictate slightly faster or slightly slower refresh as IT budgets are adjusted based on market conditions.

Christoph Schell, Chief Commercial Officer

A key part of the commercial TAM is the education segment, and we have seen a huge change in the last few years. From 2010 to 2019, the TAM moved at most up or down 3 million units a year. And then COVID hit. The TAM exploded, 62% in 2020 and another 15% in 2021 before dropping this year 29%. We don't anticipate another big jump like we saw in '20 or '21, but the change in educational practices, similar to hybrid work, we think, is here to stay. And this will drive refresh of a now much larger installed base.

Christoph Schell, Chief Commercial Officer

Not gonna lie; Christoph seems quite out of touch with the typical consumer after having been an executive for decades.

Not because of anything from above but because of the question and answer session with the various invited analysts. I’m sure he’s a nice guy, but it’s worth pointing out the oddities of his unscripted commentary. We listen to a lot of investor / executive Q&A; this was some of the worst.

I think a lot of investors probably are a little surprised at the 300 million unit long-term TAM number. How do you assess how much demand got pulled forward during COVID and thus now kind of sits behind this 6.5-year upgrade cycle?

Timothy Arcuri - UBS

So look, I, for one, don't believe that demand was pulled forward as much as category dynamics have changed. I really believe that the case in point to support that is my daughter, Maya, okay? I'll make that point again. So it's really -- I mean, she's a proxy for me for there's a new customer segment that was not really looking at PCs before.

Christoph Schell, Chief Commercial Officer

That’s an odd exchange, but it wasn’t the first time on the call

Christoph, just had one for you on the PC TAM side of things. You've given a ton of detailed information about the moving parts in there. But how are you capturing the installed base being larger but the replacement rate potentially extending even significantly further than it has in the past? As I get the hybrid work and hybrid education environment is beneficial to your installed base, but I would also imagine that could greatly extend the replacement cycle.

Ross Seymore, Deutsche Bank

On penetration. There is huge upside for us in emerging markets. I have myself lived in Asia for many years, Middle East as well. That's the areas where we see growth, and this is where we expect growth to come. And then maybe if I bring all of this a little bit together, a little bit of a personal anecdote, I'll talk about my daughter, Maya. She's 20 years. She's in college, a junior in college. And she always had access to PCs, given what I'm doing for a job -- for a living, and she never looked at them until COVID hit. And all of a sudden, she understood that consuming education content on a tablet, consuming it on a mobile phone is really not cool.

And so she lobbied me not to buy her 1 laptop but 2 because she was really concerned about not being able to dial in. So she wanted to have -- if 1 unit went down, she wanted to have 2. And that, I think, is a customer segment that was not looking at PCs prior to the pandemic and is now a very core part of what we are planning with. So I hope that gives you a bit more color and explains why we are bullish about the growth.

Christoph Schell, Chief Commercial Officer

Like dudeeeee… how are these your answers!

This has to be the most out of touch thing I’ve read this year.

Instead of diving deep into Intel’s super complex TAM model they described earlier, studying analyst reports, looking at their own sales data, the economic outlook, or the spending capacity of Gen-Z / Millennials, he decided to look at his daughter who wanted TWO laptops and thought "everyone is like this.”

Another question from Aaron Rakers of Wells Fargo asked about replacement rates for PCs again. The response from Christoph was mostly fluff yet again. It ended with him mentioning his daughter again, but oddly he didn’t even mention any numbers from the presentation that could have been useful to reiterate.

If anyone wants to read the full transcript, we’ve put it at the end of the report, as it is worth checking out.

What annoyed us was that the slides had some great numbers that Intel could use to push its narrative by reiterating them instead of that useless fluff during the Q&A.

One of the other out of touch comments from the call was about 3D displays. No consumer survey, feedback, or review has ever shown that people are clamoring for 3D displays.

I see innovation, and Michelle can talk about this in a second. But for example, what I'm really, really hyped up about is 3D displays. They are such a cool experience to have. And in my job, I have the luxury of getting early insights. I'm going to upgrade just because of 3D displays. I mean what else are you working on? You're looking into so many more innovation.

Christoph Schell, Chief Commercial Officer

Yes. I mean there are so many technologies coming. I mean, 3D displays are a few years out, a few that are available now, but I think for prime time and all the software to support them. But even just all the OLED screens that we saw last week at CES, a side-by-side comparison, like I wanted to go out and buy a new PC. I, too, have a college student. I was showing him pictures of all these things, and he was saying, "I need a new PC, that's way better."

I just think that innovation continues to spur things that we don't even know that are coming. And I think that's where it's so important is in this open ecosystem, that innovation wheel, that flywheel just continues. And we have to fuel that flywheel. And then I believe that, that brings consumers and enterprises back to the market.

Michelle C. Johnston Holthaus Executive Vice President & General Manager, Client Computing Group

Next, we will discuss the Arm vs. Intel x86 vs. AMD x86 fight with some numbers, AI’s infusion into client SOCs, and the update to the client roadmap.