As the weeks pass by, the rumors keep spinning, the likelihood of an Nvidia Arm acquisition increases. On first glance, the two businesses look completely incompatible. A highly vertically integrated graphics and AI company with very high margins buying a low margin IP licensor doesn’t make sense. Nvidia can already build any product they wish as an Arm licensee. Purchasing the whole cow doesn’t yield additional milk or synergies from the current business model. Furthermore, given Nvidia’s reputation as a partner, it would likely even cause customers to start looking for contingencies and accelerate RISC-V adoption. Jensen Huang, in his quest for data center dominance, may destroy the Arm ecosystem for everyone else.

The rational for purchasing Arm seems ridiculous to many, but Jensen’s vision is for the datacenter being a computer and Nvidia being the one to build it. They need to be to be completely vertically integrated and control every aspect of this computer. Currently they have the accelerator market on lock-down with their impressive hardware and vast software moat of CUDA/various SDKs which was built by thousands of Nvidia engineers over the last decade. With the acquisition of Mellanox, they bring the “Data Processing Unit (DPU)” of the data center in house as well. They have also continued to expand their vertically integrated software stack to networking with acquisitions of SwiftStack and Cumulus Networks.

The datacenter is a 3 legged stool, and the remaining missing piece is a CPU. AMD, Intel, and various hyperscalers are also working to build out their own 3-legged stool. The largest threat to Nvidia is Intel/AMD finally having competent GPUs and software stacks to accompany them. With the US Department of Energy dumping money into SYCL and many in the industry congregating around it, the software front is accelerating rapidly. Furthermore, various hyperscalers are rapidly building out their own CPUs with Arm Neoverse IP to hook in with their accelerators such as the Google TPU and Amazon Inferentia for AI workloads. Lastly, these hyperscalers also already have their own custom network stacks. Nvidia is currently in very strong position, but it is very precarious as their moats may all be eroded simultaneously.

In any business, in order to maintain a high margin over a long period of time, one must create barriers of entry so high, that no one can break in and disrupt. Even though Intel has stopped executing for essentially 5 years, they are still raking in the dough with >55% gross margins. Jensen Huang’s vision, if fully realized, would see Nvidia building a nearly impenetrable moat that commands high margins and locks customers in. This may sound nefarious, but Nvidia’s solution will be plug and play. The vast majority of companies do not have the resources required to build out the entire software stack to match specialized hardware. Nvidia would offer the best solution, which would eventually become an expensive deal imprisoning you in the Devil’s ecosystem.

This is where acquiring Arm rather than licensing her technology comes into play. Nvidia needs to build the moat, and the only way to do this is to effectively hijack the entire open Arm ecosystem. Developing your own CPU ISA is far too large of an investment and there would be no adoption. Even the opening up of Power and MIPS have failed to stop their slow declines to irrelevancy. RISC-V is also still in its infancy and will take many years to move into any verticals besides embedded.

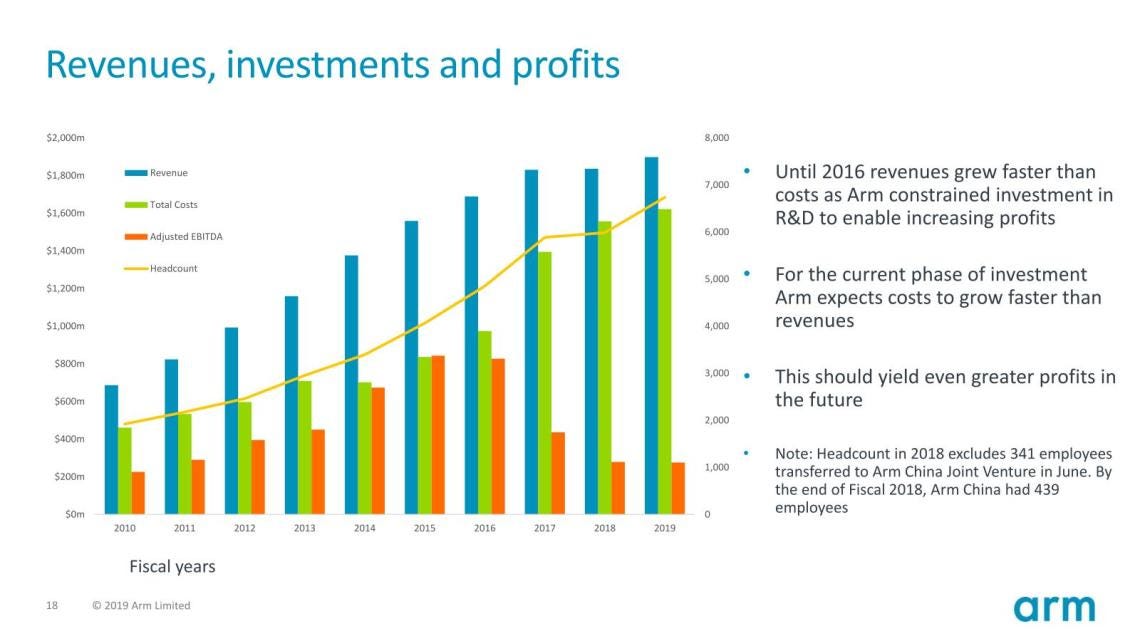

Jensen can only realize the of the vision of data center dominance by becoming the only company with the trifecta of CPU, GPU, and DPU. Nvidia can only achieve this by acquiring Arm at an unreasonable price. An independent Arm is simply not worth the $35B-$50B which SoftBank wants. Even a $20B valuation would be high valuation for Arm.

Nvidia can justify this price if they are willing to flip the semiconductor IP world on its head. The ultimate path to ROI means upending the current Arm business model. Given Nvidia’s over $300B valuation, the deal wouldn’t have to be very dilutive to current shareholders. They would start by purchasing the business in a cash/stock deal and obtaining regulatory approval. Regulatory approval initially seems like a large hurdle, but we believe it will not be. The UK will gladly approve if Nvidia makes commitments for large investments. China would be willing to look the other way if the current Arm China JV drama is swept under the rug. The EU would likely need concessions, but because Nvidia does not compete in most of Arm’s verticals, it shouldn’t be too difficult to obtain approval here either. The US regulators would be foaming at the thought of US control of Arm.

The next step would involve assuring the clients that the businesses would operate separately. Jensen has already begun telegraphing this according to the Financial Times.

As the company extends its reach to supply a complete data centre computing platform, it would sell parts of the technology as separate “layers”, Mr Huang said. Other companies would also be able to license its intellectual property for use in their own chips, rather than needing to buy silicon from Nvidia, he added.

As part of the integration of the two companies, Nvidia would cut or sell the Arm Mali GPU and Ethos NPU business. These would be redundant and can be supplemented with Nvidia’s own expertise. This would be quite the shock as Nvidia’s previous attempts to license their GPU architecture have completely failed. If Nvidia is successful in the renewed licensing efforts, we could live in a world where their CUDA architecture with accompanying software stack (read lock-in) is proliferated across phones, embedded, and the upcoming augmented reality segment. There would be some attrition as companies like Samsung have turned to licensing AMD’s RDNA graphics. In general, it would also accelerate the move out of the Arm ecosystem to RISC-V, but this will be a painful and slow move for most.

The key for Nvidia here is creating captive, dependant customers by rocking the boat, but not too violently. If the NvidiArm solution is convenient and cheap, most of the ecosystem will not attempt to rush out. Nvidia likely does not increase prices for a while in order to give their licensees an illusion of a happy status quo. Eventually, these price increases will come. The attrition will be the worst in the embedded market where RISC-V is mostly already here and players like Alibaba and Si-Five have the IP nearly ready to go.

The mobile SOC market is captive to Arm roadmaps for years to come, and this is one of the sectors Nvidia can start aggressively extracting ROI. Apple has a perpetual license and so they won’t be affected, but Qualcomm, Samsung, and Mediatek would start to sweat bullets as their licensing costs soar and they have no alternatives without their own custom core teams which have been disbanded. Mediatek specifically is highly dependent on not only ARM CPUs, but also GPUs and interconnects for many of their SOCs.

Nvidia’s largest avenue for ROI comes the data center. x86 is long overdue for some disruption. Even with AMD innovating rapidly, the world wants more options. Arm server development is being done by multiple hyperscalers and independent fabless vendors. Arm is going to break the x86 monopoly with a combination of licensed Neoverse designs and in-house designs from the likes of Nuvia or Marvell. Once the x86 duopoly is broken, Nvidia can also raise prices rapidly here. The hyperscalers in-house Arm Neoverse designs will still have better TCO than any merchant silicon, but the savings will begin to wane.

Another adjacent market where Nvidia can begin to pressure their competition is automotive. While Intel’s Mobileye currently uses MIPS and is transitioning to x86, Tesla and Qualcomm use Arm Cores. If licensing fees ratchet up here significantly, Nvidia can begin to extract margin out of their competitors’ sales. Ultimately, the CPU isn’t a competitive advantage in automotive, but just the cheapest and most convenient option.

As the Arm ecosystem matures, it will stop being the cheapest option, but only remain the convenient one. Embedded markets have already seen the light of RISC-V and the adoption can only accelerate from here. Other markets have been hooked to the drug of cheap, licensed, Arm IP. With aggressive Nvidia ownership, the junkies will have no choice but to pay up and give in to demands for the short run. They will search for alternative supplies, but this move will take a long time.

Nvidia’s endgame isn’t more revenue from licensing costs. Their endgame is a fully vertically integrated data center provider. They will want to make and control every part of the three legged stool. This means they slowly destroy the idea of Neoverse. Whether through making that IP extremely costly, or having their own in house designs be a generation ahead, Nvidia will build a moat around Arm server CPUs. Over time, Jensen Huang will muscle out other Arm vendors supplementing them with Nvidia’s in-house designs. The open Arm ecosystem will be hijacked, and be replaced with a closed off ecosystem rivaling or exceeding that of Intel and AMD.

If Nvidia can quickly seize the worlds most important IP, the most commonly used CPU ISA and designs, they will control the destiny of mobile and data center. This is Jensen Huang’s “Trojan Horse” for a Machiavellian takeover of the future of computing.

This article was originally published on SemiAnalysis on August 21st 2020.

Clients and employees of SemiAnalysis may hold positions in companies referenced in this article.