MediaTek has had a meteoric rise over the last couple of years as their silicon teams get more competent, they ship more competitive products, and fledgling units like the custom ASIC, IOT, networking, and power IC divisions fledge into industry leaders. All of this has led to their stock more than doubling since we called attention to MediaTek last year and called their stock a buy. Despite the rampant growth, they are still seen as a cheaper and lower end brand versus Qualcomm Snapdragon and Samsung Exynos.

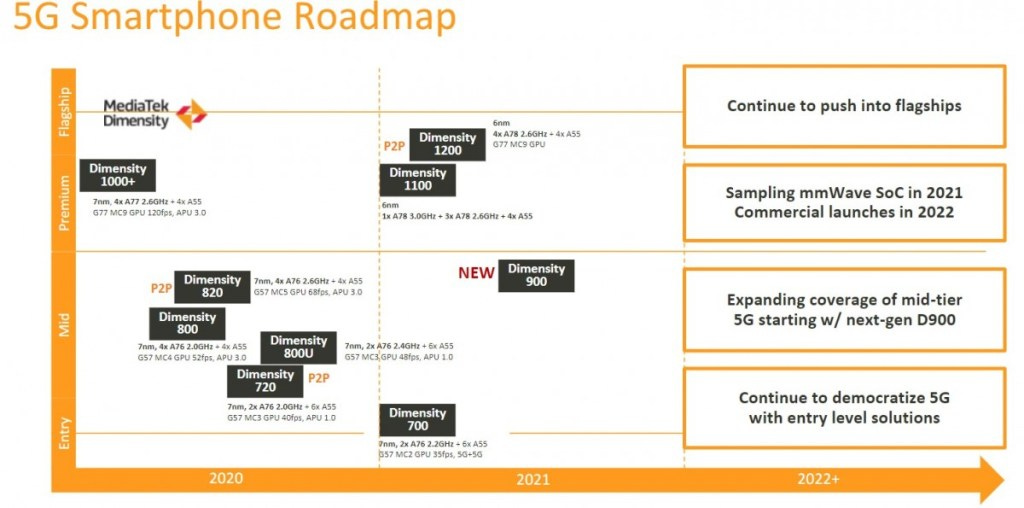

MediaTek started their push into the Premium/High-End Segment with the Dimensity 1000 line and further iterated with Dimensity 1100 and 1200. They were the first to utilize TSMC’s 6nm process node for these products. These chips are generally found in phones in the $300-$600 range. These aren’t cheap by any means, but they are not flagships.

Mobile phone, accounted for 57% of second quarter revenue, growing very strongly at 143% year-over-year mainly driven by the ramp of our 5G high-end products known as Dimensity 1000 series.

Dr. Rick Tsai - MediaTek CEO

Their great success has been driven by gobbling up market share in midrange and upper midrange. Huawei left a big hole when their mobile phone business fell apart. Their amazing performance isn’t only due to the implosion of Huawei though, they also are a technology leader.

They were the first company to ship AV1 decode, and by nearly 9 months. Intel released AV1 decode SOCs at the end of 2020, AMD and Nvidia released GPUs with AV1 decode at the end of 2020, but neither has shipped a SOC with it yet. In terms of smartphones, they were the only ones with AV1 for a full year before Samsung finally shipped in at the beginning of this year. Qualcomm and Apple still lack AV1 decode currently.

The successful engineering extends beyond AV1. Their 5G Sub-6GHz is comparable to Qualcomm and in some cases ahead. They currently lack mmWave, but they will solve this hole in the lineup very soon. They also ship the highest efficiency implementation of the standard ARM cores.

All of this leads to the recent announcements. MediaTek has confirmed the will be shipping a 5G 3GPP Release 16 capable flagship smartphone SOC based on TSMC 4nm at the end of this year for phones releasing early next year.

We are on schedule to deliver our first 5G flagship SoC solution by the end of this year. Adopting our latest flagship core and best-in-class TSMC 4-nanometer process technology, MediaTek's flagship solution offers industry-leading power consumption and premium performance.

Dr. Rick Tsai - MediaTek CEO

This would make it the first 4nm based processor and tie them with Qualcomm on 5G Sub-6GHz capabilities. Qualcomm will also be shipping a 4nm based SOC with 5G 3GPP Release 16, but it will be on the Samsung 4nm process technology. The Samsung 4nm technology is in between TSMC 6nm and TSMC 5nm in density.

Other specs include a CPU layout containing an X2, 3 A710, and 4 A510 cores. This would be identical to the CPU configuration that Qualcomm and Samsung will use next year, but it will be shipped on a superior process node. MediaTek is known for cheapening out on caches, but this is reportedly not the case this generation. With a 1MB L2 cache, 8MB L3 cache, and 6MB LLC, MediaTek is throwing the gauntlet down and looking for CPU supremacy in the Android smartphone chip world. With these flagship CPU and modem specs, MediaTek is targeting a flagship price.

When we look at Qualcomm, they must be selling their Snapdragon 888 at about $100 per chip excluding RF. Is that the pricing window that you see being achievable for your flagship chips coming out towards the end of this year?

Question

The price you mentioned in your statement indeed is something our flagship product, I think, should and will achieve. We're talking about RMB 4000 (~$615 USD) and above we all consider as a flagship. We believe the market size is about 80 million units to 100 million units next year.

Dr. Rick Tsai - MediaTek CEO

All this translates to MediaTek moving into a new echelon of smartphones and directly challenging Qualcomm in the $615 to $800 range. They will not be able to move into the final segment without mmWave and an improved GPU architecture. The GPU side of the equation is very rough with Arm’s Mali graphics being significantly worse than Qualcomm Adreno and the upcoming Samsung AMD partnership for RDNA graphics. On mmWave, they will solve that with the next iteration.

The first SoC with the millimeter wave modem is doing well. It's doing well. We continue -- we will continue to say that the second half of next year is the time for our product launch.

Dr. Rick Tsai - MediaTek CEO

This would be their subsequent flagship SOC which would ship in phones early 2023. This is going to be another step forward and bring them fully competitive in the $800+ segment, assuming they can get a handle on GPUs. The most exciting thing about this SOC is not the mmWave even, but that it most likely is the first smartphone SOC with TSMC’s 3nm technology.

MediaTek continues to grow at a rampant pace, and they are likely will be the next semiconductor company to cross $20B of revenue. They are looking like they will be slightly ahead of AMD in this race, but it is too close to call. Like AMD with TSMC’s advanced packaging, MediaTek seems to have forged a special relationship with TSMC. They shipped the first 6nm SOC nearly a year before anyone else, with AMD only coming in on the node early next year with their Rembrandt APUs. They are shipping the first 4nm before anyone else as well, meaning they would have the title of highest density node. While 4nm is an evolution of the 5nm family, the 3nm node is a brand-new node, and it’s possible MediaTek comes first to this node as well.

The Android smartphone SOC world is finally getting exciting again, with MediaTek’s meteoric rise, Samsung’s deal with AMD, and Qualcomm planning to integrate Nuvia CPU cores built by a team of mostly former Apple engineers!

This article was originally published on SemiAnalysis on July 28th 2021.

Clients and employees of SemiAnalysis may hold positions in companies referenced in this article.