The new cold war between the US and China is heating up again with Huawei being banned from having their in-house processors fabricated using American equipment. American companies such as Lam Research and Applied Materials have virtual monopolies in certain sub segments of the semiconductor equipment field. Without this equipment, advanced processors cannot be fabricated by TSMC, Huawei’s largest partner. TSMC only has a 100 day grace period, after which, they can no longer work with Huawei. To add insult to injury, TSMC, has also agreed to build a 5nm fab in the US, showing where their allegiance lies. Huawei’s custom mobile SOCs, 5G network chips, and embedded business are all under grave danger due to this new ruling.

Other companies such as Xillinx, Cisco, Nokia, and Ericsson all stand to gain market share in their various fields as well, but these markets move slow, and Huawei has stockpiled well in advance for these business units. The mobile smartphone market moves much quicker to new chipsets, and 5G means new generations are happening even more frequently. There are 5 major companies which design mobile SOCs, Huawei, MediaTek, Samsung, Apple, and Qualcomm. Apple is solely for internal use, and Samsung is mostly internal with their external business facing stiff competition from Mediatek and Qualcomm. Huawei has limited choices in the mobile space. They can either cede all their business away, or switch to using Qualcomm and MediaTek SOCs. Given there is a new cold war going on, it is fairly clear who a company with close ties to the CCP would choose.

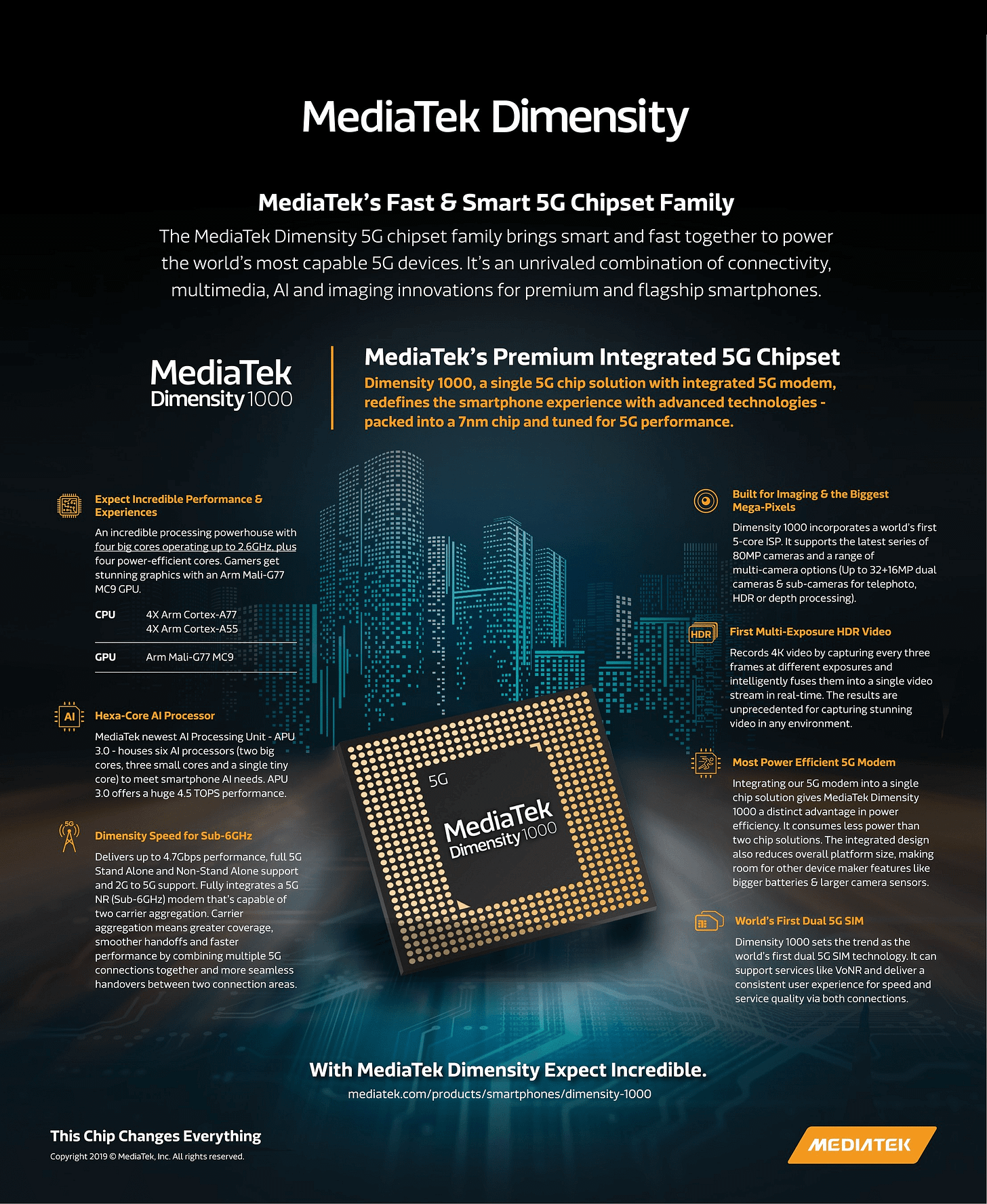

MediaTek has a very impressive range of processors ranging from lower midrange up to nearing flagship levels. Decisions such as moving to 7nm class nodes, offering advanced NPU, media capabilities, and flagship tier modems allow all but the upper echelons of flagship smartphones to have a place for MediaTek SOCs. No one can match Qualcomm at the flagship tier for 5G SOCs and modems, but most sales are not in this price bracket. MediaTeks newest offerings include the competitive 1000 and 800 series chips with integrated 5G modems. These chips will saturate and dominate the $300-$700 smartphone market. These modems have a glaring lack of mmWave 5G technology as Mediatek has chosen to focus purely on Sub 6GHz spectrum. This is consistent with Samsung and Huawei’s modem ambitions as well. Outside of the US, mmWave is gaining extraordinarily little traction. Exacerbating this issue, only Qualcomm provides mmWave modems and antenna modules. Given the positioning, MediaTek’s cellular radio offerings are effectively flagship tier in most of the world. Due to this, Mediatek is offering products that allow it to move up in the value chain to a tier they have not previously played in.

Given Huawei’s own chipsets and modems will cease production within the next 100 days, they are scrambling for an alternative to the internally designed Kirin SOCs. Outside of China, Huawei have already lost meaningful market share due to the loss of Google Play Services last year. Instead of ceding this share to foreign companies such as Samsung and Apple, Chinese vendors such as Vivo, Oppo, and Xiaomi have picked up the slack. SemiAnalysis expects this trend to continue with a steady glide down from Huawei. According to a new DigiTimes report, MediaTek has already obtained increased orders from Huawei, Oppo, Vivo and Xiaomi. These increased orders are not only filling the hole from the loss of Huawei’s Kirin SOCs, but likely also include market share losses from Qualcomm in China as the CPP looks to restrict American companies operating in China.

Huawei has multiple contingencies in place outside of ordering from Mediatek. They have also begun producing 14nm based Kirin 710A at the Chinese logic foundry, SMIC. SMIC is just beginning to ramp 14nm FinFet technology, but it is unknown if SMIC will be able to continue due to their relationship with Huawei and resulting US restrictions. Despite having a second source from SMIC in the midrange, the Chinese smartphone market is a ripe opportunity for MediaTek. With sanctions being lobbed at Huawei, and a Chinese reaction excepted, there is only 1 direction for the Taiwanese bystander to go.

This article was originally published on SemiAnalysis on May 22nd 2020.

Clients and employees of SemiAnalysis may hold positions in companies referenced in this article.