Nvidia is the backbone of the Artificial Intelligence revolution.

Nvidia is the only firm providing vertically integrated artificial intelligence solutions for the datacenter, edge, robotics, healthcare, the digital metaverse, and manufacturing.

Nvidia is the only semiconductor firm that actually understands software.

Nvidia is the only firm that is cloud native, but understands its biggest competitors are the cloud giants.

Nvidia is the only semiconductor firm that is fighting against these cloud giants by allying with on premises, enterprise, and edge.

Nvidia has vision.

And Nvidia is overvalued.

Jensen Huang’s vision for computing is spot on, but the fundamentals of this company do not reflect the stock price. We are big fans of Nvidia. Their solutions are ingenious. Many of their competitors are being left in the dust because they are not prepared for the AI & data-centric world.

It is a fantastic company, but it is not currently worth more than $500B. The stock price has run away from the actual business. Nvidia recently announced a 4 to 1 stock split, and since then, the stock has risen a meteoric 40%. This increase in stock price is purely based on bidding up by institutions and retail investors. It has no ties to the underlying business fundamentals.

SemiAnalysis believes a stock price correction will happen relatively soon.

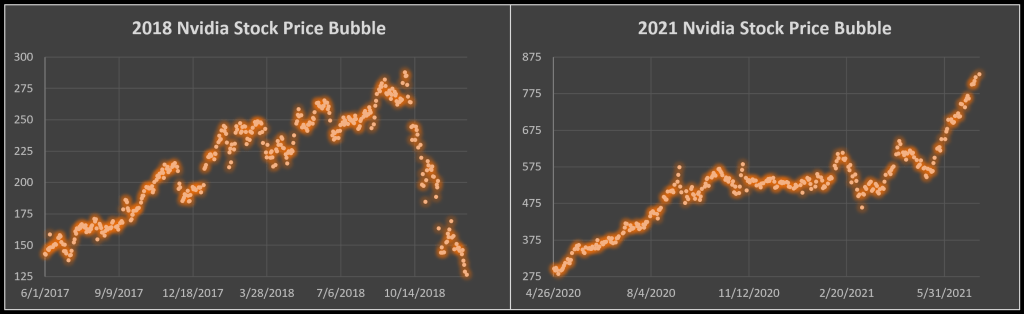

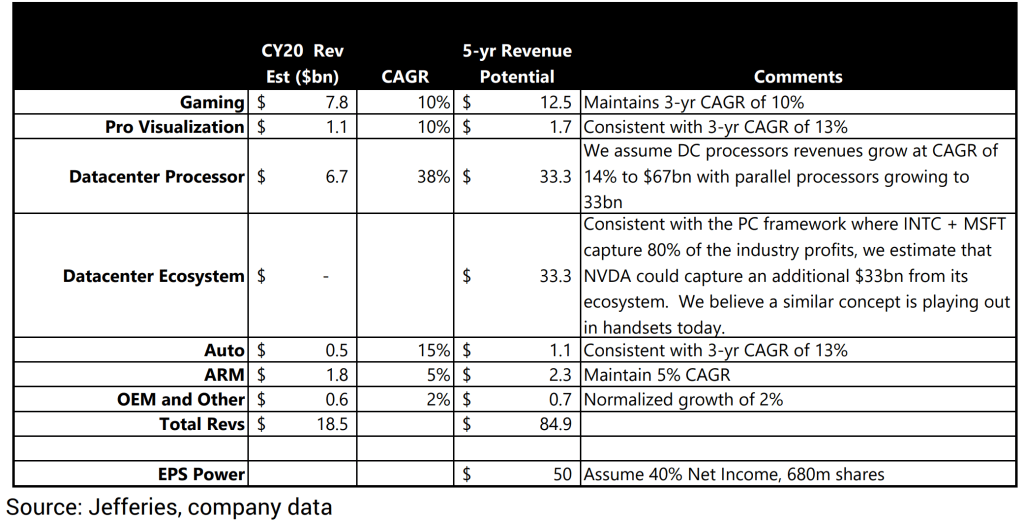

This is not the first time Nvidia’s stock price has run away from the business. 2018 had an eerily similar setup. The market dynamics were somewhat different, but the core trend of temporary outsized growth persists. As a result, the banks take the outsized growth and extrapolate it out to absurd conjecture. This is done to justify ridiculous stock price targets. The following is from Jefferies, but most of the banking sell-side reports showcasing similarly absurd deductions.

We will not rip into their numbers, or the ridiculous datacenter ecosystem narrative they spun. It is just too easy and frankly unfair to tear apart the clueless sell-side banking semiconductor analysis.

In many ways, this overvaluation cycle is even worse than the previous one.

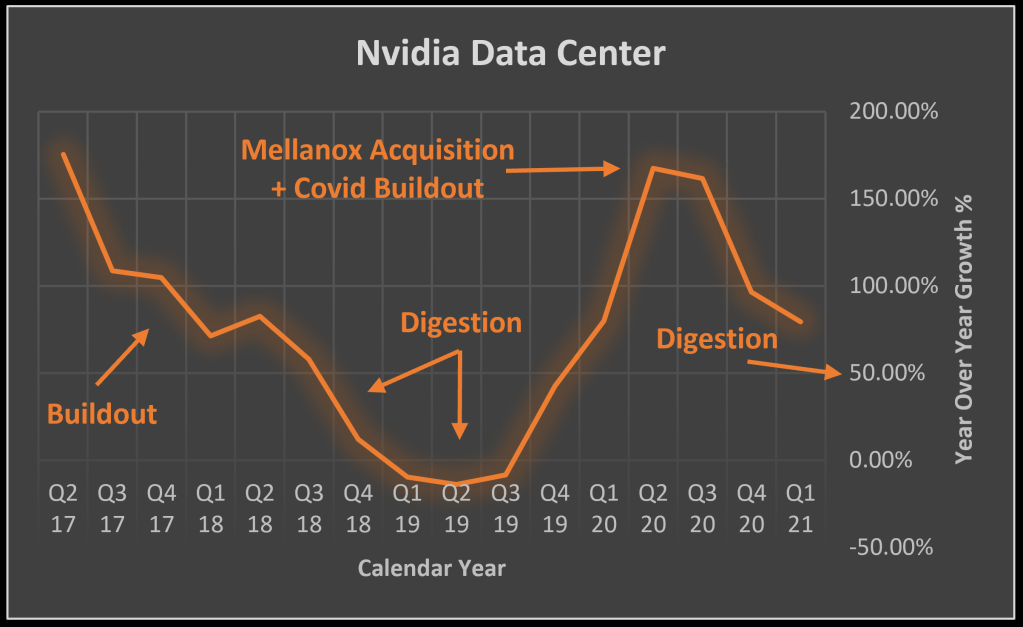

The cyclical nature of the datacenter buildout has led to boom-and-bust cycles. This buildout has a digestion phase on the back end, but that is being completely ignored by many. This happened with the previous cycle, and it is happening again this cycle. We would even wager this cycle’s peak is more extreme than the last on a nominal growth basis.

Covid and the digitization of the workplace has pulled forward years of societal structural changes. As the Covid pandemic begins to lift, there will be a digestion phase for the PC, cloud, and networking business. A return to the mean for these markets will occur and knock down datacenter growth to more reasonable figures.

Some of the less sophisticated investors are even ignoring what the Mellanox acquisition has done for year over year growth figures. They are erroneously applying them forward!

Nvidia datacenter growth will not shrink like the previous cycle as it is a larger and more stable business, but it will not be able to sustain the high triple or double-digit year over year growth that it has seen lately. SemiAnalysis believes that by end of the year, datacenter growth rates will be below 50%.

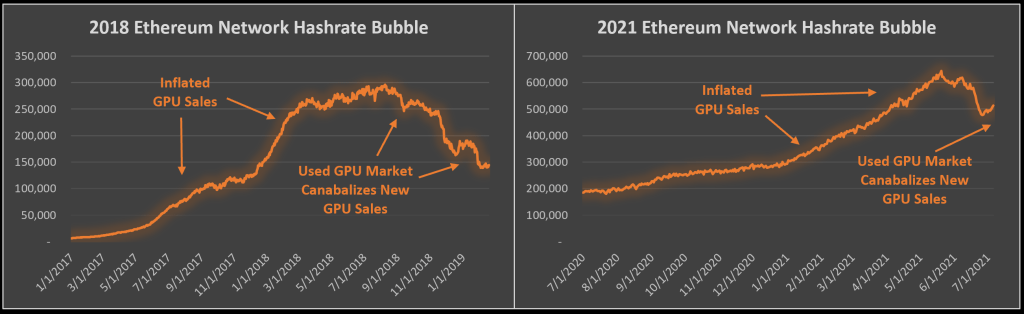

Just like the last cycle, there is a huge cryptocurrency bubble causing graphics cards to constantly be out of stock. The increase in hashing power this cycle far outstrips the previous bubble. The number of graphics cards slaving away in the cryptocurrency mines grew faster than the previous bubble.

People may scream that Ethereum ASICs exist (chips specifically designed to mine Ethereum coins), but the semiconductor world was very tight before the meteoric rise. These crypto mining firms cannot magically get a leading-edge wafer allocation from TSMC. They cannot pull wafer allocations from other clients that offer long-term demand to TSMC. They do not have the ability to snap their fingers and make substrates appear from thin air.

As cryptocurrency pricing has tamed, GPU pricing is already rapidly approaching sane levels.

Furthermore, unlike the previous cryptocurrency mining bubble, there is no possibility for a future one. This was the final cryptocurrency GPU based mining bubble. Bitcoin has been fully ASIC for a long time, and Ethereum is moving that way too. More importantly, the Ethereum foundation is making major changes to the network such as moving to a proof of stake model. This will crush mining returns.

Do not confuse us, gaming is in a super cycle and there are a lot of gamers that will buy GPUs, but the >100% growth rate is nowhere near sustainable. As the world opens, some people will do things besides sit at home and play games. The covid pandemic created a long-term shift in the favor of gaming, but this is one that also has a digestion phase. The gaming business will not shrink in the second half of this year. As we move into next year, it is very likey that gaming sales flatten out completely.

The worst aspect of the current Nvidia stock price bubble is that it is partially fueled by a stock spilt. It has soared 40% on what many jaded people will call market manipulation. A stock split does not increase enterprise value of a company. Fractional shares are offered on most of the retail platforms, so a split does nothing to increase the pool of investors.

Yet many investors are buying because stock splits have led to big pumps. They likely hope to get out before the price dumps. Most recently, another firm with valuations that are far ahead of any business fundamentals had the same thing happen. Tesla is a firm that many would categorize as being a visionary leader, just like Nvidia. Many people believe that Tesla is changing the energy and automotive world, just like Nvidia is for computing and AI. Tesla announced a stock price split and the stock soared to record levels. After the split occurred, the price tanked.

We believe this pattern will occur again. Nvidia likely will not crater below $300B total market cap, but they will fall below the $500B+ they sit at today.

The catalyst for Nvidia’s stock price correction is the split. As we approach the split of pass it, people will begin to sell. As gaming GPUs approach MSRP, people’s wild expectations of the gaming market’s growth will be tamed. As we enter the 2nd half of the year, datacenter sales growth will continue, but at a slower pace.

We like Nvidia and if the price is right, would recommend buying it, but that price is not the current one.

This article was originally published on SemiAnalysis on July 6th 2021.

Clients and employees of SemiAnalysis may hold positions in companies referenced in this article.