Q3 Semiconductor Roundup – $ENTG $AMD $CRUS $MPWR $POWI $ON $AMKR $ASX $GFS $QCOM $QRVO $SWKS $MKSI $ICHR $COHR $MXL $KLA $NVMI $ONTO

Smartphones and RFFE expectations bottoming, but there's reasons to get bullish here

Semiconductor earnings season is still going strong, and tons of important details should be highlighted, even if specific subsectors of the semiconductors industry are not that important to you. As always, the supply chain is massive and tangled, so transcripts and earnings often read through to other parts of the supply chain. We will look at the direct impact of China sanctions on some of these firms where applicable.

Today we are sharing another roundup of the semiconductor world. In this issue, we will cover Entegris, AMD, Cirrus Logic, Monolithic Power Systems, Power Integrations, Onsemi, Amkor, ASE, GlobalFoundries, Qualcomm, Qorvo, Skyworks, MKS Instruments, Ichor, KLA, Onto, Nova Instruments.

Entegris – ENTG 0.00%↑

First, a bit of a victory lap to quench our ego. On our earnings preview last week, we warned about Entegris.

Their guidance will be below consensus expectations for Q4 in our view.

We went on to explain why, but the short answer is that Entegris is primarily a volume-driven company, and wafer start cuts across tier 2 foundries as well as the memory players, Micron, SK Hynix, Samsung, Western Digital, and Kioxia sting.

Other earnings across the semiconductor industry, especially the volume-driven low visibility firms we covered last week, such as FormFactor, screamed warning signals for Entegris.

The China regulation impact totals $40M to $50M each quarter, less than 5% of their quarterly revenue.

We believe 2023 will be worse than consensus expectations. There is room for the stock to continue to fall. Entegris is levered up and has the Capex in Taiwan at the same time, which pressures free cash flow in a market where free cash flow is everything. We could easily argue that Entegris should fall to a much lower multiple given these issues. They overpaid for CCMP, and it will bite them in the butt. $COHR and $MXL got punished for this, and so will $ENTG, although to a lesser extent.

AMD - AMD 0.00%↑

AMD had interesting earnings. The quarter was as expected, given that they pre-announced a miss. The Q4 guidance was a surprise. The guidance was below the sell-side, but client and gaming were the entire reason for that miss. AMD’s reaffirmance of datacenter and embedded meant that investors didn’t quite care about the client-driven losses.

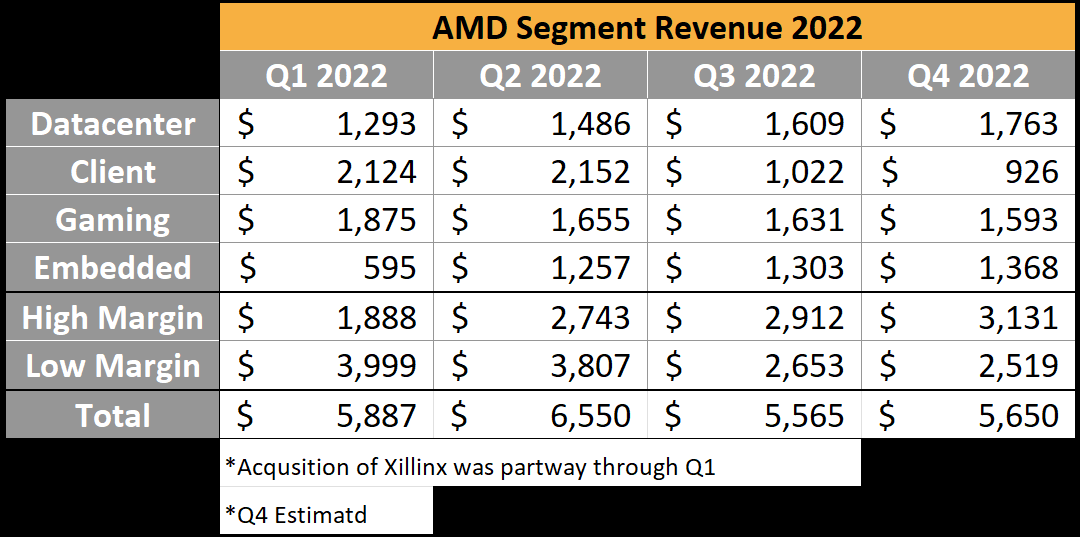

The table below shows 2022 revenue across segments. AMD is under shipping end demand. Based on Intel’s guidance and AMD’s guidance. H2 2022 total client x86 PC share is 84/16. That’s a marked decrease in share.

The arguments can stretch both ways. One is that AMD is depleting inventory faster at OEMs than Intel. We agree with this to a certain extent, but that’s not the whole story.

Intel has excess capacity, and the economics of an IDM versus fabless is very different. Intel needs to maximize utilization, and incremental unit cost are low. On the other hand, AMD can flex wafer supply and doesn’t get much of a discount/charge for it given their agreements with TSMC.

AMD’s current product line is not that competitive in the client market. In the notebook market, Rembrandt wins on battery life and GPU performance, but the top-line CPU performance figures still lean toward Intel. Furthermore, some enterprises are wedded to using Intel’s vPro or stuck to Intel. That leaves Rembrandt with a narrow high-end market of users who care about performance and the chip they have but not the maximum CPU performance.

AMD does gain share there, but next-generation Dragon Range and Phenoix need to change the conversation measurably; we must wait for Strix for the picture to change significantly. With most of the market, midrange and low end, Intel have the performance lead and pricing lead versus Barcelo and Mendo. AMD likely doesn’t get back to 20% PC share till late next year at best.

AMD is effectively vacating the market for the medium term and letting Intel undercut them. Lisa Su effectively said they would not chase the market down on a pricing front.

Moving on to our 2023 estimate, our datacenter estimates are unchanged from last month’s in-depth report on the 2023 DC market by quarter for revenue, units, and ASP for the Genoa/Bergamo ramp. Commentary on the earnings call strengthened our view.