Rockley Photonics Will Revolutionize Healthcare By Measuring Biomarkers Such As Glucose With Lasers In The Apple Watch

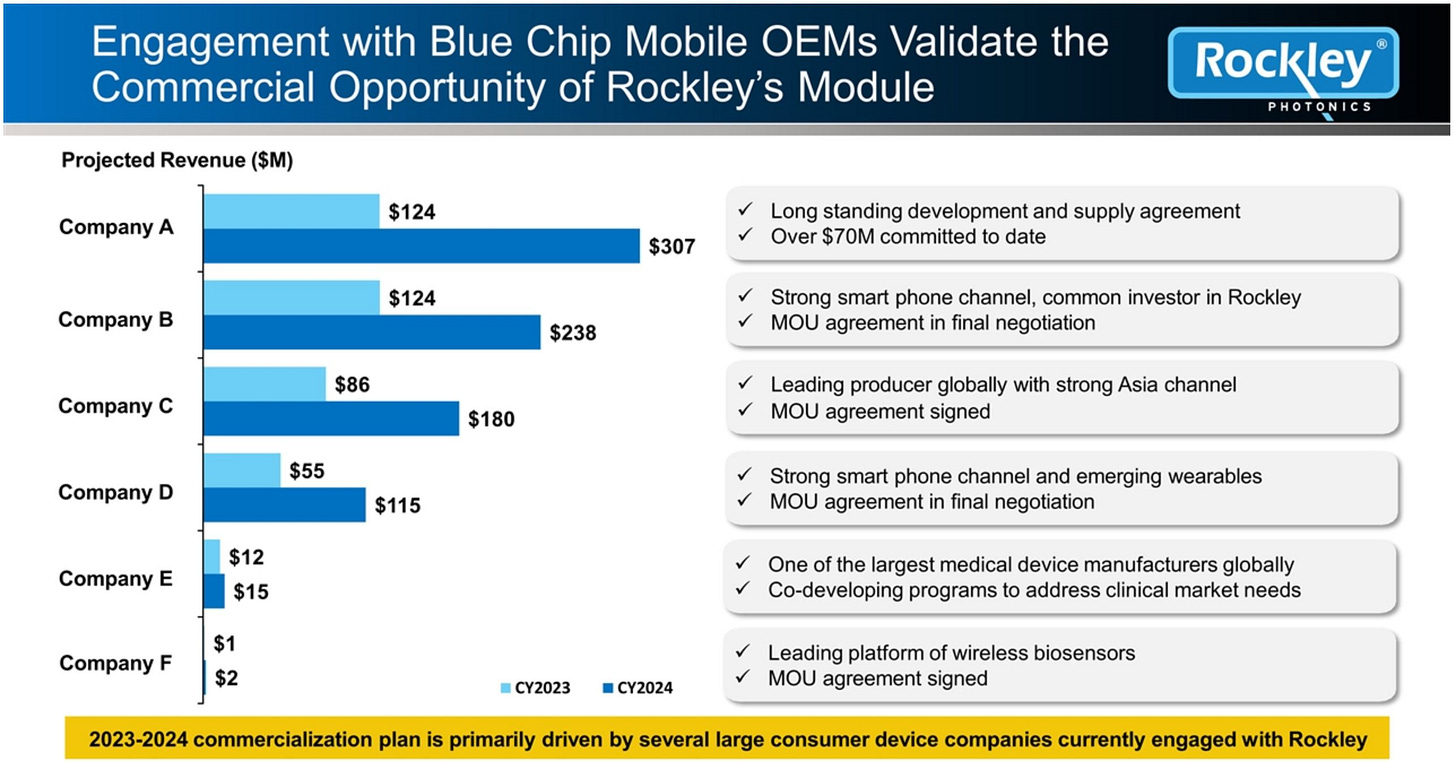

Rockley Photonics is a silicon photonics firm focused on medical technology that is going public through a SPAC ($SCPE). They have developed a novel, non-invasive multimodal method for biomarker monitoring. Rockley’s method involves many lasers on a single microchip being bounced off a human to measure lactate, alcohol, CGM (glucose), hydration, body temperature, blood pressure, blood oxygen, and heart rate. This technology that Rockley has developed is so compelling, Apple has already paid them $70M in engineering fees. SemiAnalysis believes that Apple watches in 2022 or 2023 will begin integrating this photonic sensing platform.

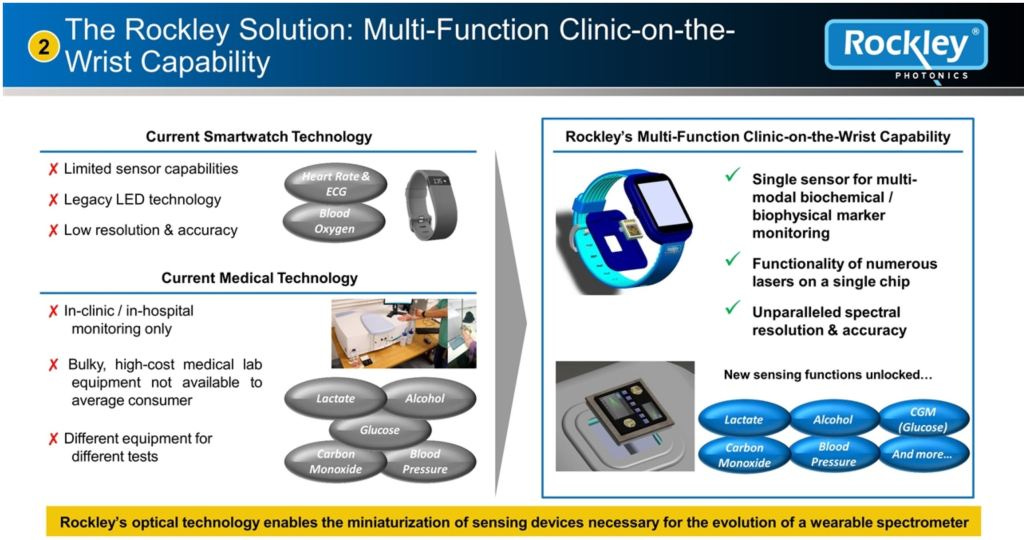

We believe is transformational versus existing technology in terms of its range, accuracy, and efficiency. Other companies in this space attempt to use LED technology, which is a much lower resolution, narrower wavelength, and slower than the photonics-based solution of Rockley. Currently deployed in smartwatches, LEDs shine light into your skin, monitoring the scattered light that comes back to measure your pulse and even blood oxygen levels. Apple is disrupting the health monitoring industry by incorporating this into their current watches, but these sensors are not medical grade. Rockley’s platform is essentially a laboratory spectrometer on a chip. It offers a whole host of tests and monitoring services which creates a “clinic on a wrist”.

Traditionally, when you shrink an optical instrument, the performance generally gets worse as you allow less light into the device. In this case, the innovative architecture is designed to allow the device to have two orders of magnitude improvement over the traditional benchtop instrument. The proprietary silicon photonics based lasers and spectrographs are capable of a higher resolution and accuracy than anything else in the market, covering the entire infrared and visible light spectrums. In addition to the photonics chip, Rockley has developed an ASIC that can interpret the spectroscopy results.

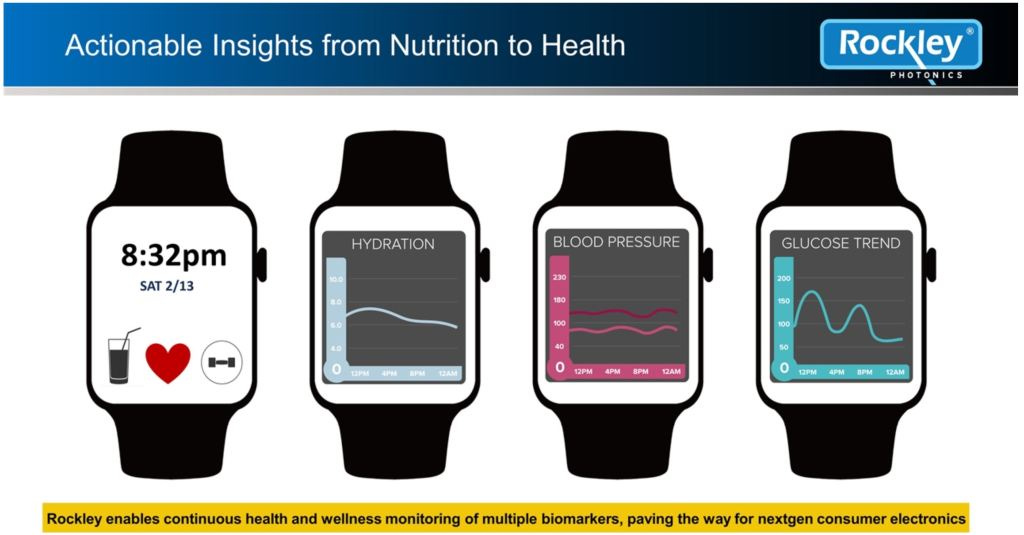

This technology will work anywhere on the body where there is reasonable levels of blood perfusion. Deep analysis of the light scattering will allow items such as hydration, blood pressure, and glucose trends to be closely monitored. Diseases that often develop and worsen due to lack of patient monitoring can be caught much earlier. One simple example is that rather than testing glucose once a day, or wearing an intrusive continuous monitoring device, diabetic people and those with family history can wear a non-intrusive smartwatch. This watch will notify you and any doctor you choose when your glucose levels spike or get too low. You can immediately take corrective action rather than risk diabetic shock. Devices with the Rockley Photonics platform can provide early warning signs of the onset of diseases, so a more efficient treatment of those diseases can take place. People suffering from chronic disorders can manage their lives more effectively and easily.

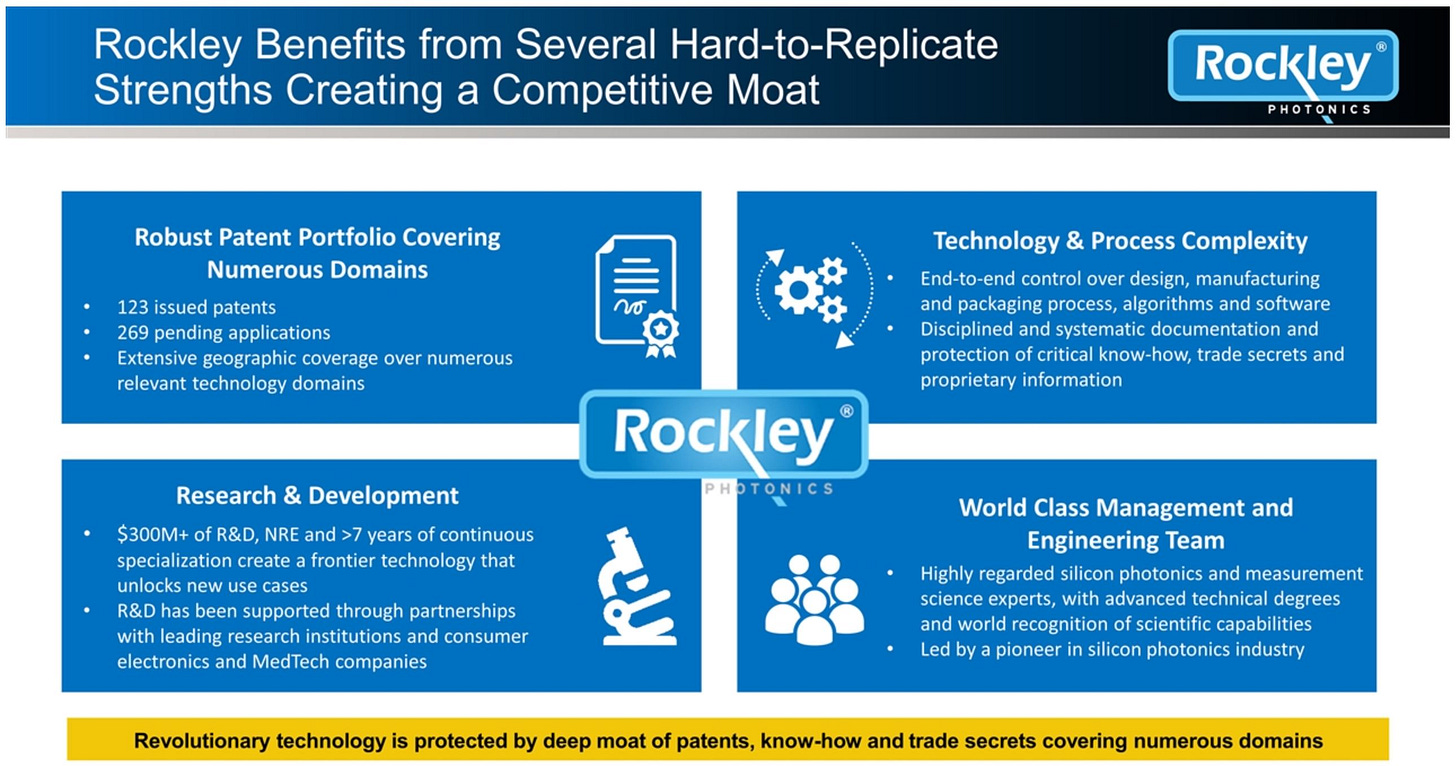

Rockley Photonics has a protective moat around their business which prevent it from being replicated. With 122 accepted patents and a custom and proprietary process technology, it would be exceedingly difficult to replicate the hardware. They have a range of silicon and III-V photonics and electronics design expertise, co-packaging technology to put electronics and photonics together, firmware / software to run these chips, and the biosensing algorithms to measure and read individual biomarkers. These algorithms represent an important component of the IP as these are developed through clinical trials over a representative human population.

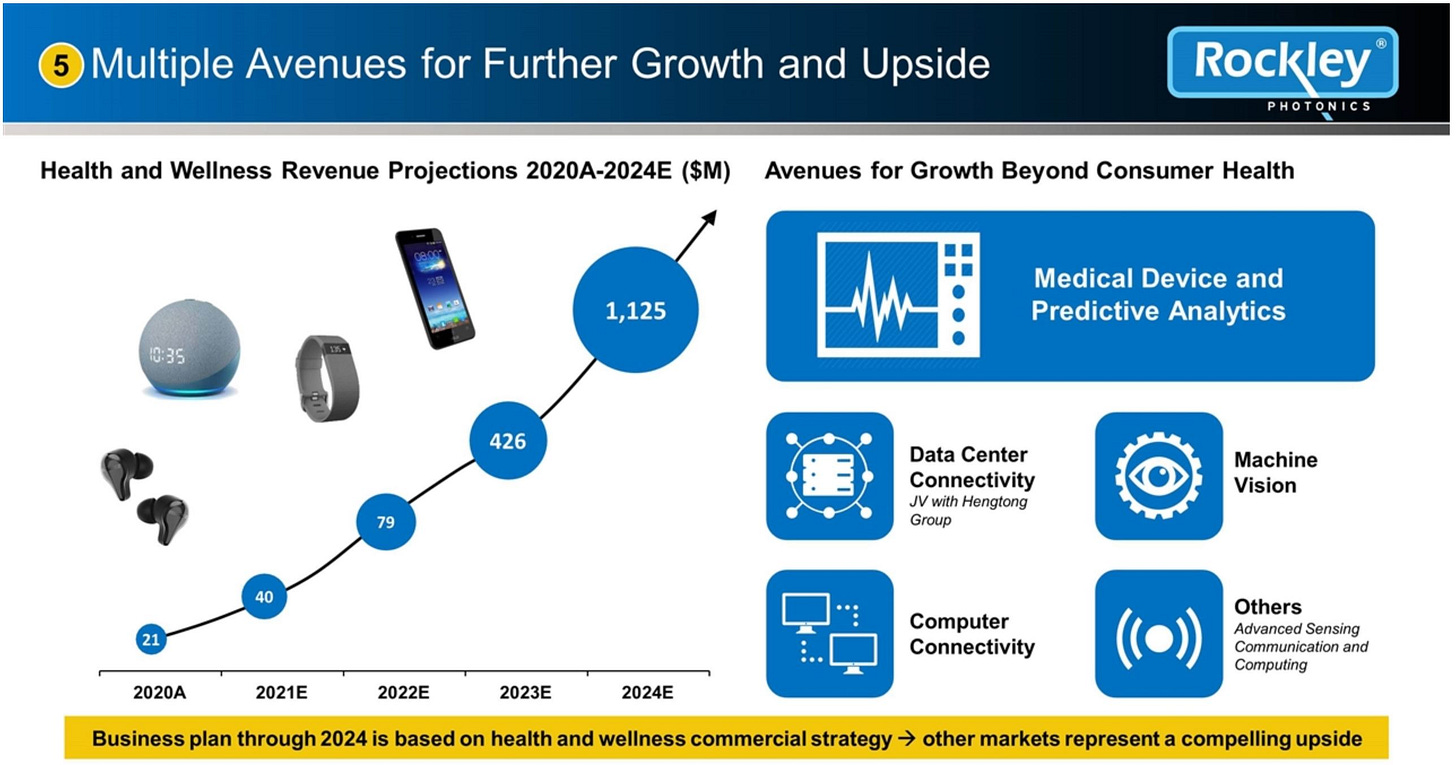

Rockley will initially target the consumer health and wellness market. They are engaged and contracted with the majority of smartphone and smartwatch makers. Medical devices will also be a big target market for them. There is a possibility for many clinics to replace an entire array of sensors with Rockely Photonics powered medical devices. Leading medical devices equipment manufacturers are engaged. This technology will take longer to proliferate and become productized due to FDA restrictions, but they already have traction there.

Beyond that there is the possibility for growth in datacenter connectivity through their JV with a Chinese fiber optic cable producer, Hengtong Group, to produce optical transceivers. We have written about the Intel’s silicon photonics potential and GlobalFoundries leading edge photonics foundry service for further background in this market. This joint with Hengtong is a possible growth vector simply because the Chinese domestic market will likely wish to create a domestic ecosystem and distance itself from the western silicon photonics world. Rockely Photonics believes there is a possibility for share in Lidar for robotics and automotive, but we believe this market is already saturated by stronger competitors.

The trillion dollar tech giants that seem to shape our world and control our data seem to think this is where we are headed. On a bit of a more somber note, they would love to have access to all your data. We believe only Apple would properly keep your health data protected and only for your benefit. Early adopters of Rockley Photonics platforms could have a tremendous advantage in capabilities. Facebook has a smartwatch coming, and I have no doubt they will skirt HIPPA protections by targeting health-based advertising to you without selling your health data to others directly. They could use this data and advertising revenue to subsidize the product initial cost and have droves of people buying it at exceptionally low prices. This vision is more of a dystopian future, but whether for selling devices or your data, it is clear this technology is will be adopted by all consumer technology giants.

This is a huge consumer health market opportunity. We could easily foresee insurance companies fully subsidizing the cost of devices equipped with Rockley Photonics based platforms for high-risk customers, or maybe even all customers. Addressing a diabetic imbalance early on would save them tens thousands of dollars in hospital bills and pay for the subsidized or free smart watches. It is a no brainer for insurance companies to rapidly adopt this technology. Clinics would love to be able to offer low cost and rapid testing for all patients. Non-invasive testing is a must because many patients are simply lazy or scared of intrusive testing and monitoring products in the market. They would rather avoid the doctor than deal with a mild level of discomfort by being pricked or prodded by medical instruments.

Covid made the entire medical field rethink diagnostics and testing. People became more unwilling to go to clinics than ever before. A side effect of covid lockdowns is that people may go to clinics for testing less as a long term trend as they became accustomed to this behavior during Covid.

Other healthcare challenges include a growing prevalence of costly chronic conditions, health systems that are strained by demand, and high-cost, non-invasive monitoring solutions that are only available in-clinic. All of these concerns are unmet by existing technology, as there is a lack of integration across wearable and medical devices, inability to miniaturize benchtop solutions, limited use cases, and non-scalability of existing technologies.

In walks the Rockley Photonics solution, which is a multi-functional clinic-on-the-wrist. Their wearable spectrometer technology brings a single sensor for multi-modal biochemical / biophysical marker monitoring through the functionality of numerous lasers on a single chip that results in unparalleled spectral resolution and accuracy. Some of the new sensing functions unlocked include lactate, alcohol, glucose, carbon monoxide, blood pressure, and more.

Rockley Photonics is in a unique position where their proprietary technology platform and the market opportunity have them ripe for huge amounts of sales. The $70M in engineering fees that Apple has already paid them without a single consumer product shipped is testament to this disruption. Consumer technology is a world of "me too". When Apple does something, everyone rushes to copy. Rockley Photonics is the single source for this technology.

Rockley Photonics biggest advantage is that they have a custom, proprietary process, and packaging technology within the independent Newport Wafer Fab. They have over 20 employees working inside this fab for the photonics integrated circuits as well as the indium phosphide lasers. These are then bonded together on a wafer scale then diced to create a single chip solution. This is then packaged alongside a TSMC fabricated Rockley Photonics designed ASIC. This chain of techniques and proprietary technology allows their technology to be hard to replicate. It also allows them to retain the advantage of the fabless semiconductor company model by being able to have low capex and ramp production fairly easily.

Rockley is projecting revenue out through 2024. These revenues only assume integration of their chips with those whom they are already engaged. It includes 0 earnings from their Chinese joint venture and 0 earnings from medical devices because of nebulous FDA timelines. Given this revenue roadmap and potential upside from medical devices, the joint venture, and higher uptake rates, valuation seems very fair. Company A is Apple.

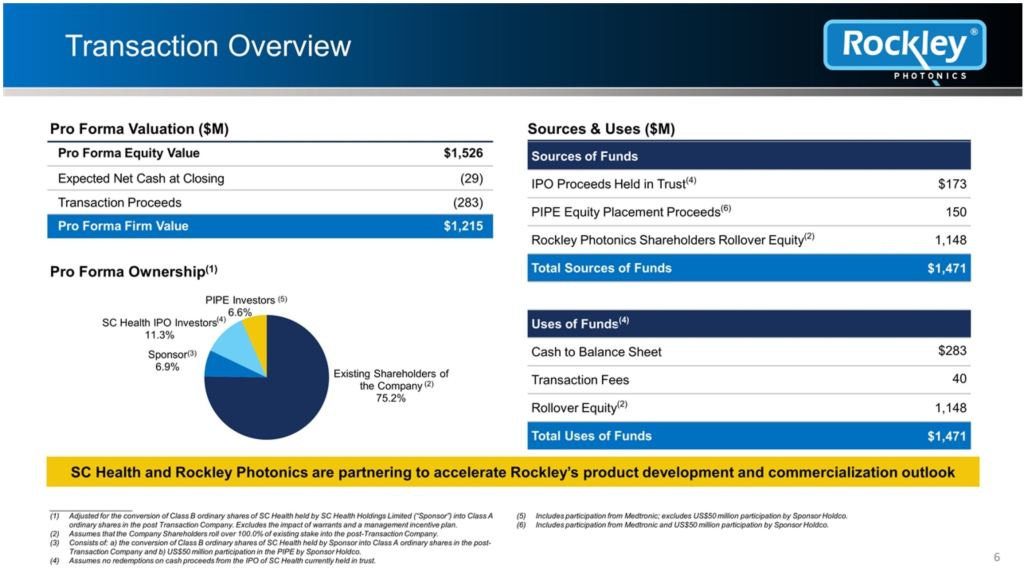

Rockley is valuing themselves at $1.215B. Their total funds will be $1.471B. Of which, 100% of equity from current company owners will be transferred over. None of the current ownership wants to sell. Instead, they want to raise $283M for minority share in the company. These funds will be used to fund product ramp, commercialization, and launch. Unlike many SPACs and go public deals, the founders and early investors do not want out. They want to dilute their ownership slightly in order to scale their company to the next level.

The management, engineering, and operational teams are no slouches. They are heavily technical people with strong backgrounds in successfully products and companies. The CEO of the firm has a long history of successful companies in silicon photonics. The idea of silicon photonics was proposed in the mid-1980s. Not too long after he founded one of the first silicon photonics company to commercialize the field, Bookham. It was backed by Intel and Cisco and eventually taken public on the Nasdaq. The company went on to be known as Oclaro and now is part of Lumentum. He chaired a second company in the field called Kotura, which had a similar journey in fiber optic communications with a second-generation process. It was successfully sold it to Mellanox in 2013, which in turn was acquired by Nvidia last year. That’s when he started Rockley Photonics.

The Chief Operating Officer and a highly experienced engineer and operations manager as former EVP of Operations at Source Photonics. The VP of Sales and Marketing and was the former GM of Product Line at Texas Instruments with a Ph.D. at Stanford. The VP of Product Engineering and a very decorated engineer, one of the founding engineers, who won the Bell Labs Award in 2016. The EVP of Engineering and was the former VP of Engineering at Marvell Semiconductor.

The Senior Director of Sensing Product Module Development was formerly CEO of TruTouch Technologies, which basically pioneered the infrared spectroscopy that is implemented in Rockley Photonics technology. Rockley acquired TruTouch’s assets and engineering teams. They have been working on using silicon photonics capabilities to miniaturize the proven benchtop measurement technology that TruTouch invented. Their leader for the Sensing Cloud and AI Product development efforts was formerly Senior Director of AI Products at Intel and holds a Ph.D. from Caltech.

Rockley Photonics has a deep bench of industry expertise throughout the entire company, ranging from fundamental semiconductor technology, photonics design, packaging, consumer products, medical devices, software, and AI / cloud applications. They had 82 Ph.D.’s and 156 engineers at the time of filing, and they have been hiring aggressively since then.

Rockley Photonics is not a new firm bursting onto the scene. There are decades of work, including TruTouch Technologies which goes back to 2005. Success and promise of their technology lead to starting a relationship with Apple all the way back in 2017. They have worked with very closely including the national research institute of Finland (VTT), CalTech, Southampton University, and the Irish Center for Microelectronics Developments (Tyndall Institute).

More recently, they have seen an expansion in investor base to include medical technology and semiconductor investors. Applied Materials, the largest firm that develops equipment which manufacture computer chips, is even an investor. They like to invest in firms that are using tools in an interesting or innovative way, which Rockley Photonics custom proprietary process for photonics does. So far Rockley Photonics has raised $390M in equity and non-recurring revenue such as the Apple $70M engineering fees.

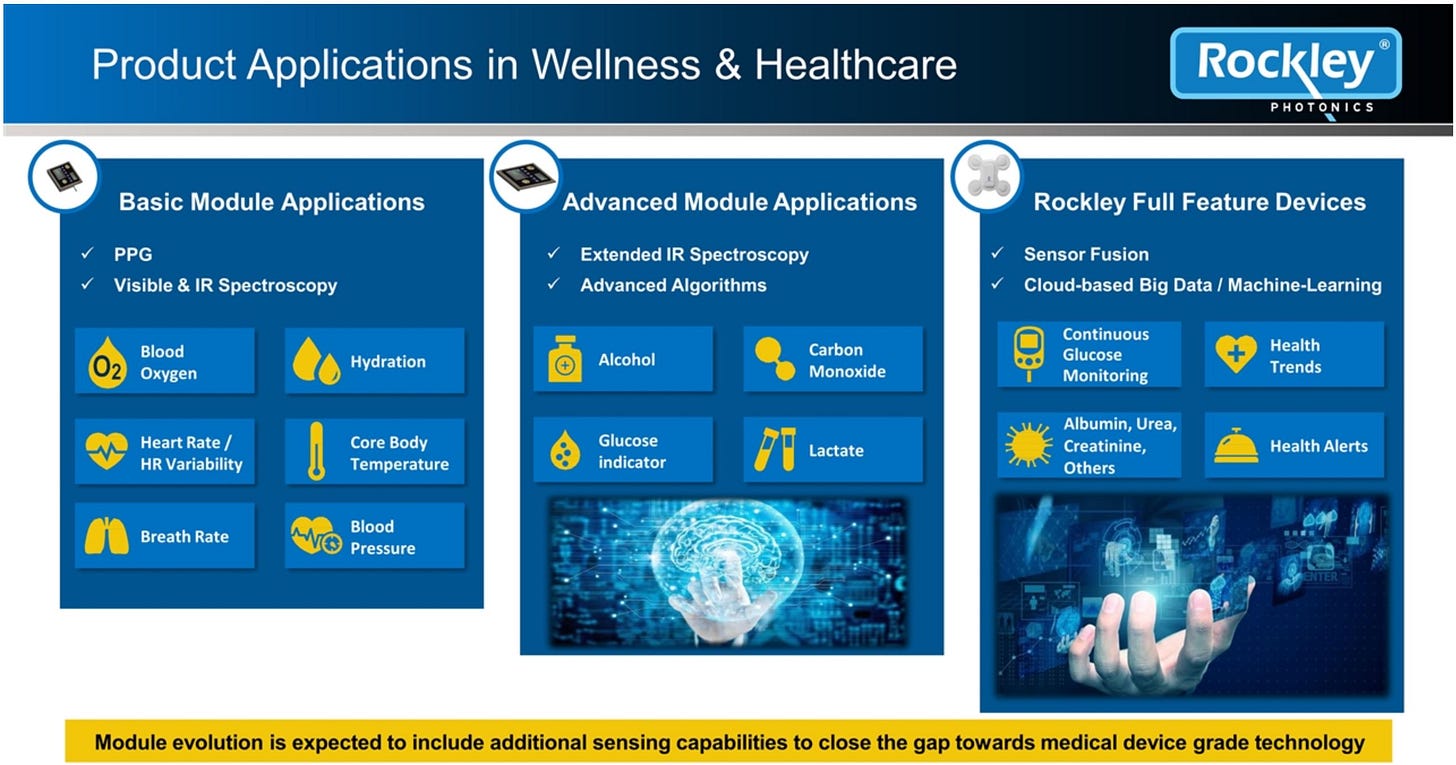

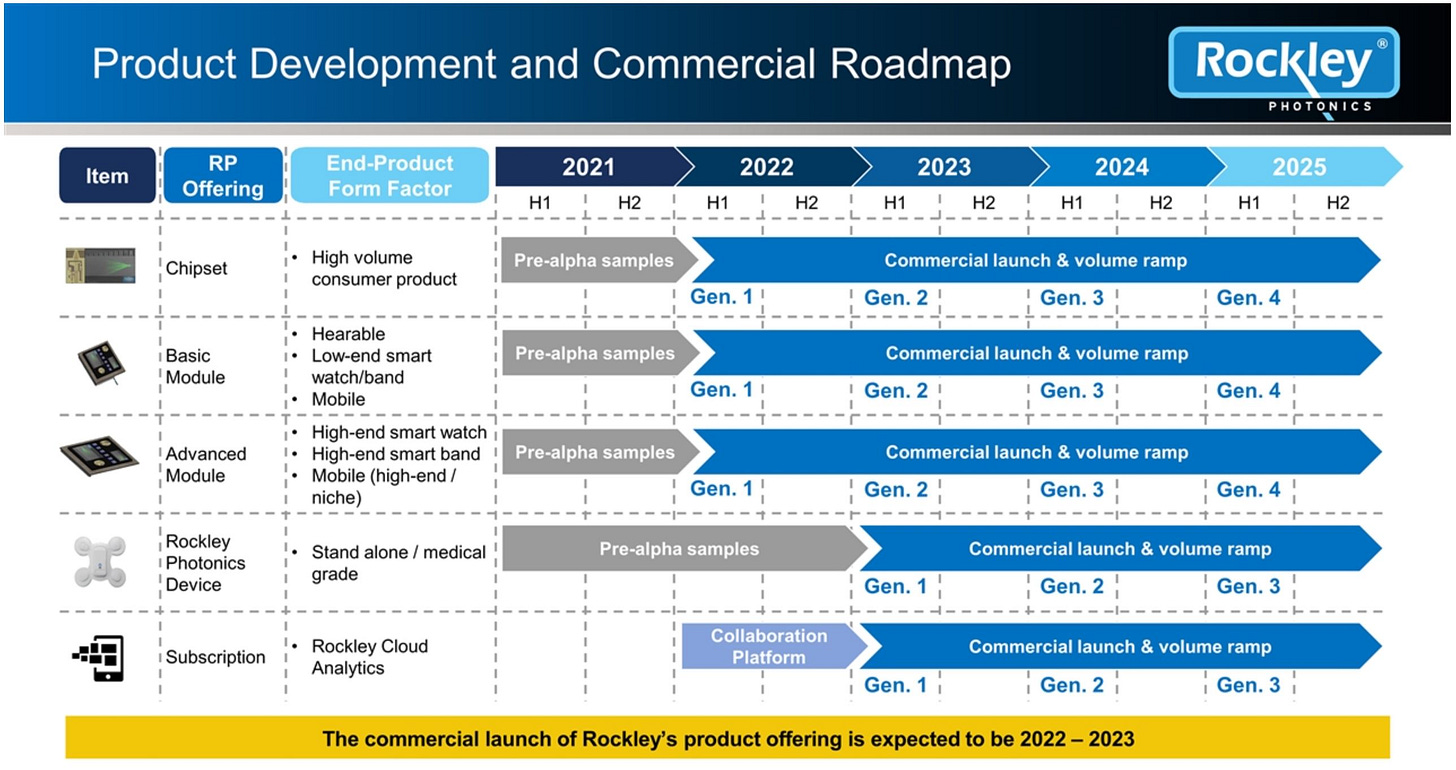

Rockley Photonics is going to release 3 platforms. The basic and advanced modules will be made available for the consumer electronics world and launch in 2022. The basic module contains what you already see today in a high-end smartwatch, which are blood oxygen, heart rate, and breath rate. The basic module will far surpass any LED based technology in the market in accuracy. It also adds to that biomarkers that are in great demand including hydration, core body temperature, and blood pressure.

The advanced module has double the number of lasers as the basic module. They extend the infrared spectroscopy range and use more advanced algorithms to detect alcohol, carbon monoxide, glucose indicator, and lactate. This will enable non-invasive continuous glucose monitoring, the holy grail of medical diagnostics.

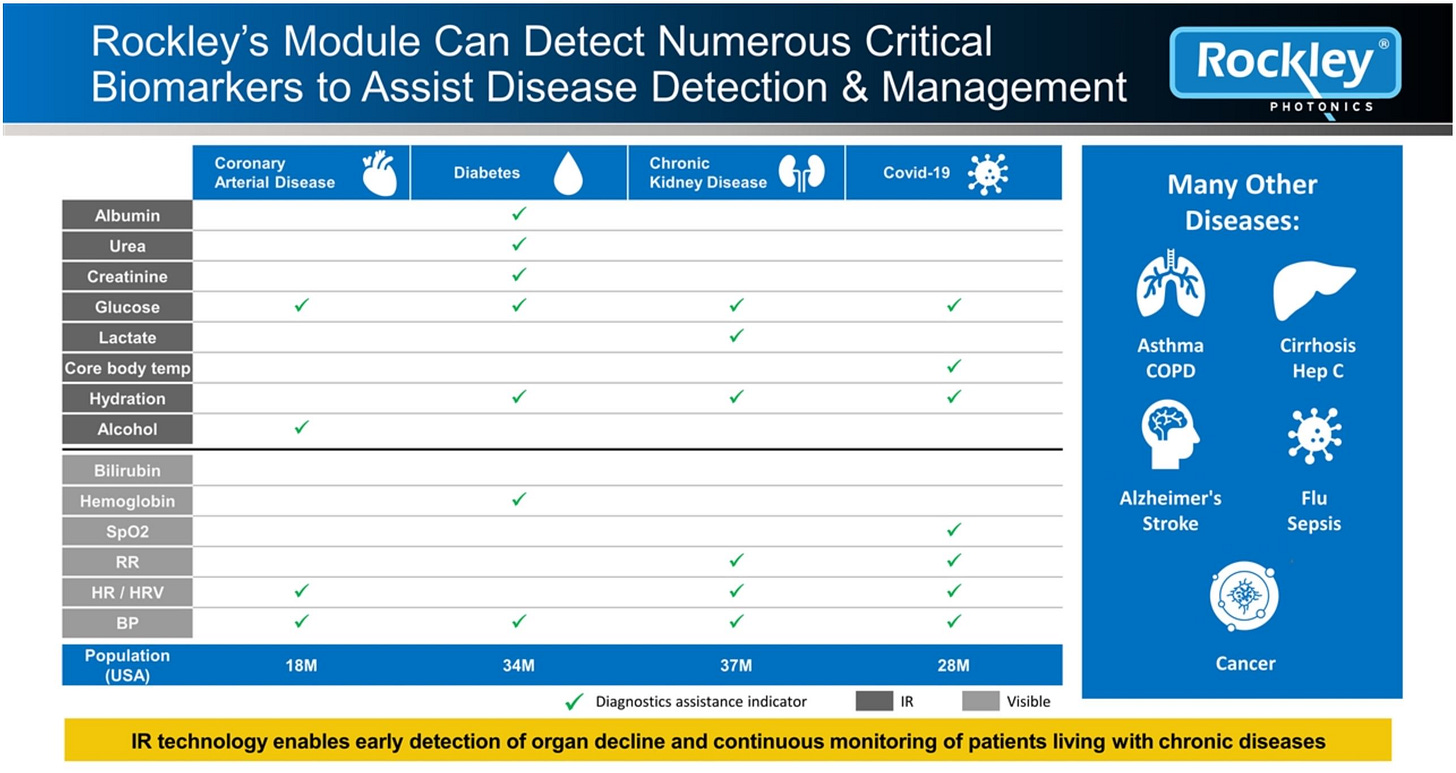

Rockley Photonics is being conservative by making no claims or financial projections at the moment because they need FDA approval. This is a massive potential upside for investors. Other biomarkers they are investigating in this device include albumin, urea, and creatinine, which through continuous monitoring can produce health trends and alerts for disease detection and management.

Rockley Photonics will also launch cloud analytics capabilities to support all these end markets. They are willing to sell their chipsets separately if a customer chooses that option. As software algorithms improve, capabilities for these sensors will also improve.

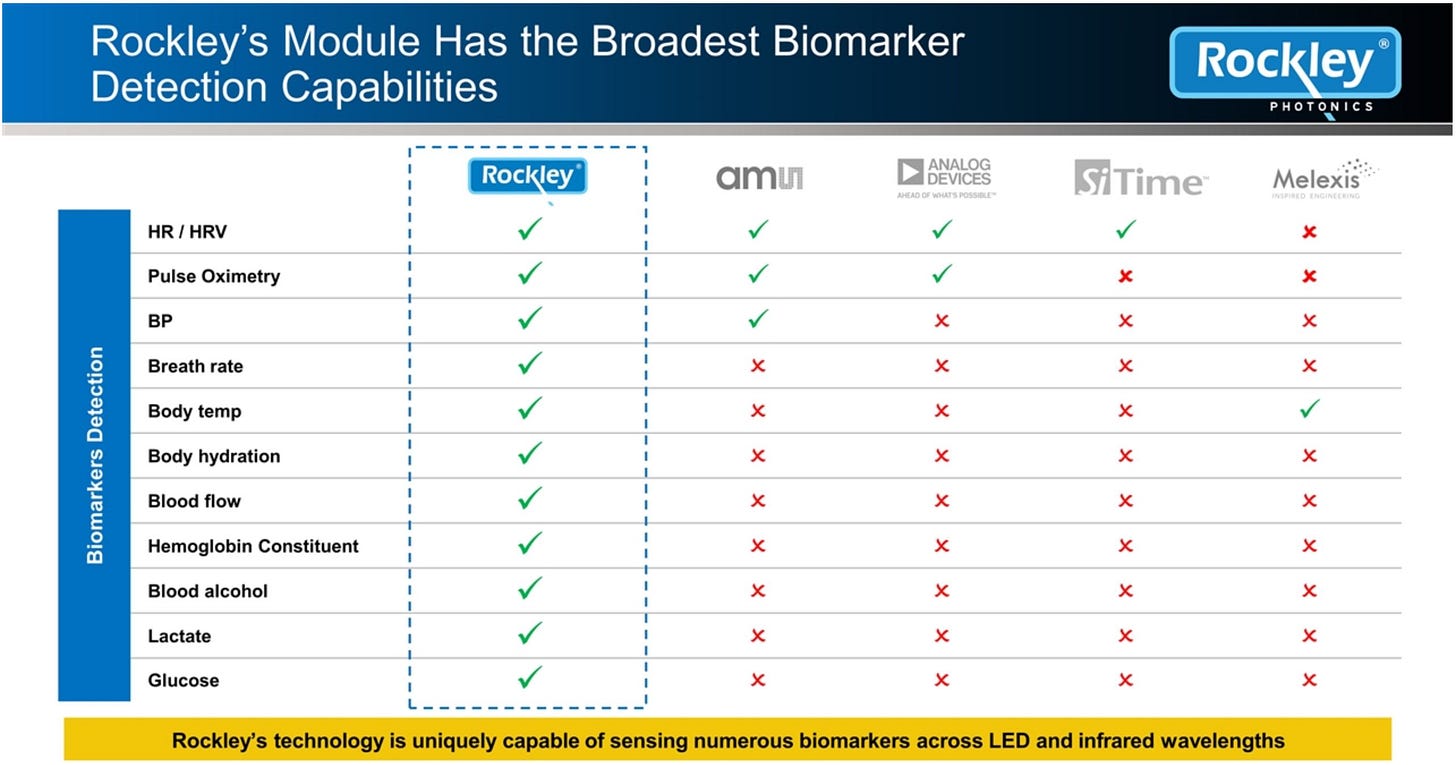

The competitive landscape based on existing alternative optical sensing technologies is weak. There are a limited number of features in the other players products. Rockley Photonics’ unique spectrometer chip can dramatically increase the biomarkers measured. Other potential market entrants include the broader photonics companies, but those players are mostly focused on data communications and Lidar applications. None of their process technologies today have the performance specifications, process scalability, or measurement capabilities to meet the consumer wearables market opportunity. These players would have to rearchitect their platforms to allow them to have the optical bandwidth and the right properties to address this market, along with the lengthy development of the measurement science.

Rockley Photonics believes this is a long journey for them and there is a large barrier to entry. They have a huge moat with hundreds of patents. They have a proprietary process that cannot be easily replicated, and many years of R&D. This likely cannot be replicated easily and allows Rockley Photonics to be a virtual monopoly in this new and emerging field.

Rockley Photonics is being very conservative with their market penetration statistics. If they beat their goals, revenue projections would make their current valuation way too small. This is the main reason current investors do not want to sell. They simply need to raise more capital to go after the market opportunity.

Rockley Photonics aim to impact disease prevention and management by partnering with MedTech companies. They are currently conducting robust human clinical trials to develop FDA-approved medical grade devices. If you map the biomarkers that are involved in the indications of these various diseases, Rockley Photonics’s module could potentially be used to detect these critical biomarkers to assist in disease detection and management.

In diabetes, it’s not just glucose levels that are important, there’s also great benefit in monitoring several other biomarkers as shown. In COVID-19, there are machine learning model-based studies that show how certain biomarkers, such as glucose, core body temperature, and hydration, can assist in the early assessment of how the infectious disease is likely to progress and whether an individual will suffer severe symptoms that should be treated sooner or if they will experience mild symptoms and can be sent home. Rockley Photonics is also in discussions with medial partners to develop uses of the technology for early cancer detection and monitoring of chemotherapy patients’ wellbeing.

Given Rockley Photonics huge market opportunity with industry revolutionizing technology, it could potentially be a great investment. Big customer wins like Apple validate the technology. The fact that all current investors wanting to stay invested is a very bullish signal on this technology. The fabless model with people inside an independent fab with a proprietary process creates a large moat that cannot be penetrated. The financials are conservative, strong, and represent a meaningful upside, and the management team has a strong track record of delivering on their promises.

This article was originally published on SemiAnalysis on June 22nd 2021. More financials related to Rockley Photonics can be found there.

Clients and employees of SemiAnalysis may hold positions in companies referenced in this article.