Semi Supply Chain Cutting Expectations as Phone Sales Plummet

There is finally news of orders being cut in the semiconductor supply chain. A breath of fresh, but a very worrisome one semi stocks have traded down massively on concerns of an overbuild and weaker 2022 and 2023. SemiAnalysis believes that the next few years will continue to be huge growth years, but recent order cuts are not to be trifled. The new wave of Covid-19 in India, South America, and other developing economies is slowing phone sales significantly as well as impacting the supply chain itself.

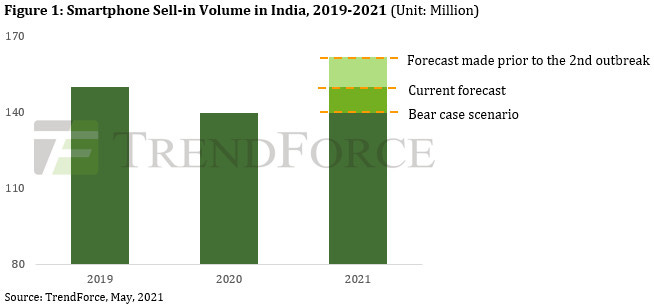

India is the most impacted region as factories have shuttered and sales have tanked. Other developing economies are also being affected. TrendForce has estimated 12 million fewer phones will be produced in Q2/Q3 of this year.

This could be a low estimate due to the banning of ships with crew from India or that have been to India. About 240,000 of an estimated 1.6m seafarers globally are from the India, according to International Chamber of Shipping, an industry body. China has initiated this behavior and Singapore has widened its ban to cover crew from countries including Pakistan and Bangladesh. Indian factories likely will not be able to import the required materials for continuing production. In a time where inventory levels are at record lows, production cannot be sustained.

SemiAnalysis total phone sales projections for the year have dropped by roughly 50 million units assuming the Covid-19 pandemic comes under control reasonably quickly. Furthermore, the lowered consumer demand has also caused average sales prices of phones to fall. Cheaper phones have significantly lower silicon content due to lower end SOCs, less capable cameras, and simpler RF solutions. These effects are causing Apple, Samsung, Xiaomi, OPPO, and Vivo to reassess their production plans and it will be reverberated through the supply chain.

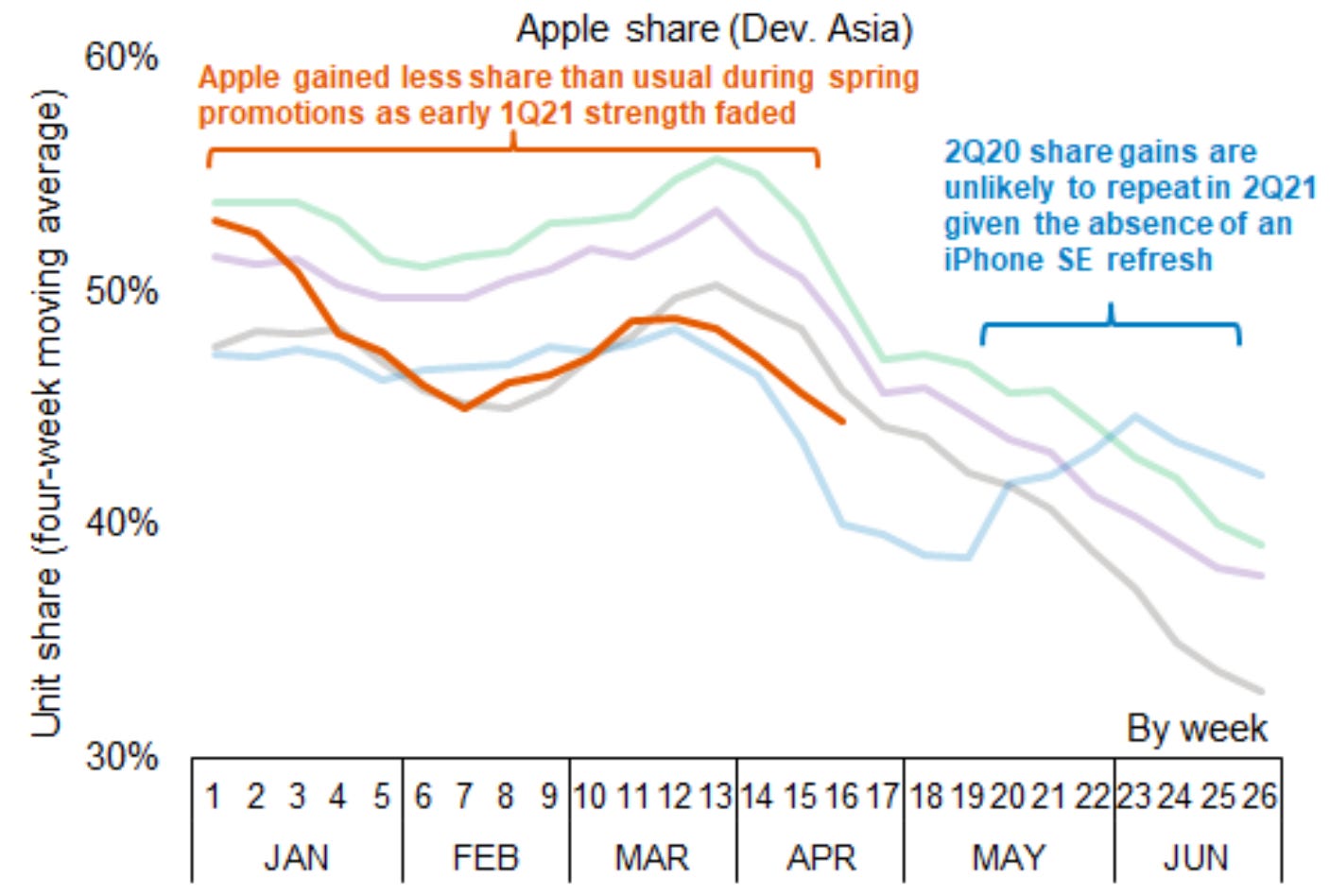

Apple for example is already adjusting. Despite Q1 being the strongest Q1 ever, there is a large quarter over quarter decline expected for Q2. In fact, SemiAnalysis believes it will be the largest quarterly decline ever on a percentage basis from Q1 to Q2 in iPhone sales history. This isn’t only due to Covid in the developing economy, but also in China and Europe. Furthermore, a higher percentage of these sales are iPhone SE and the lower end 12 lineup.

Outside the Apple world, the reduced orders of components particularly will hit MediaTek the hardest as they have been the wining the most share and are dominant in the most affected markets. SemiAnalysis continues to expect Qualcomm to be unable to supply demand for their products until next year despite these reduced orders.

Players in the OSAT and ICs have plummeting orders for some components. People invested in the numerous Taiwanese companies at play here should lower their expectations for 2021. Not everything is peachy keen in the year 2021, for the darling semiconductor industry.

This article was originally published on SemiAnalysis on May 11th 2021.

Clients and employees of SemiAnalysis may hold positions in companies referenced in this article.