Everyone is aware of the semiconductor downturn, but many questions remain. How bad will the semiconductor downturn get? How high are inventory levels going to grow? How many orders will be canceled? How low will fab utilization rates go? Will the downturn persist through the 2nd half of 2023? Will the downturn be a V-shaped recovery with a strong end of the year? Will the resurgence be sluggish even into 2024?

Our analysis points to a downturn far worse than companies in the industry and Wall Street expected. Inventory will not reach normalized levels in Q2 2023 as most wish due to record high inventory levels. These inventory levels exceed prior downturns, such as the 2008 Financial Crisis and the Dot-com bubble in 1999-2000.

Today we want to dive into the semiconductor industry's inventory levels for the largest 71 companies over the last 25 years. These 71 companies represent all aspects of the supply chain, including equipment, memory, foundry, IDM, fabless design, mobile, RF, OSAT, power semiconductors, and systems. We will include our raw at the end of this report.

The current semiconductor cycle will be more drawn out and deeper than most expect. Due to this, we believe there is a ~15% downside for semiconductor companies’ valuations or significant sideways movement before the real bull run can start. This is not across the board, broadly. Some will have more significant declines, and some companies have already bottomed.

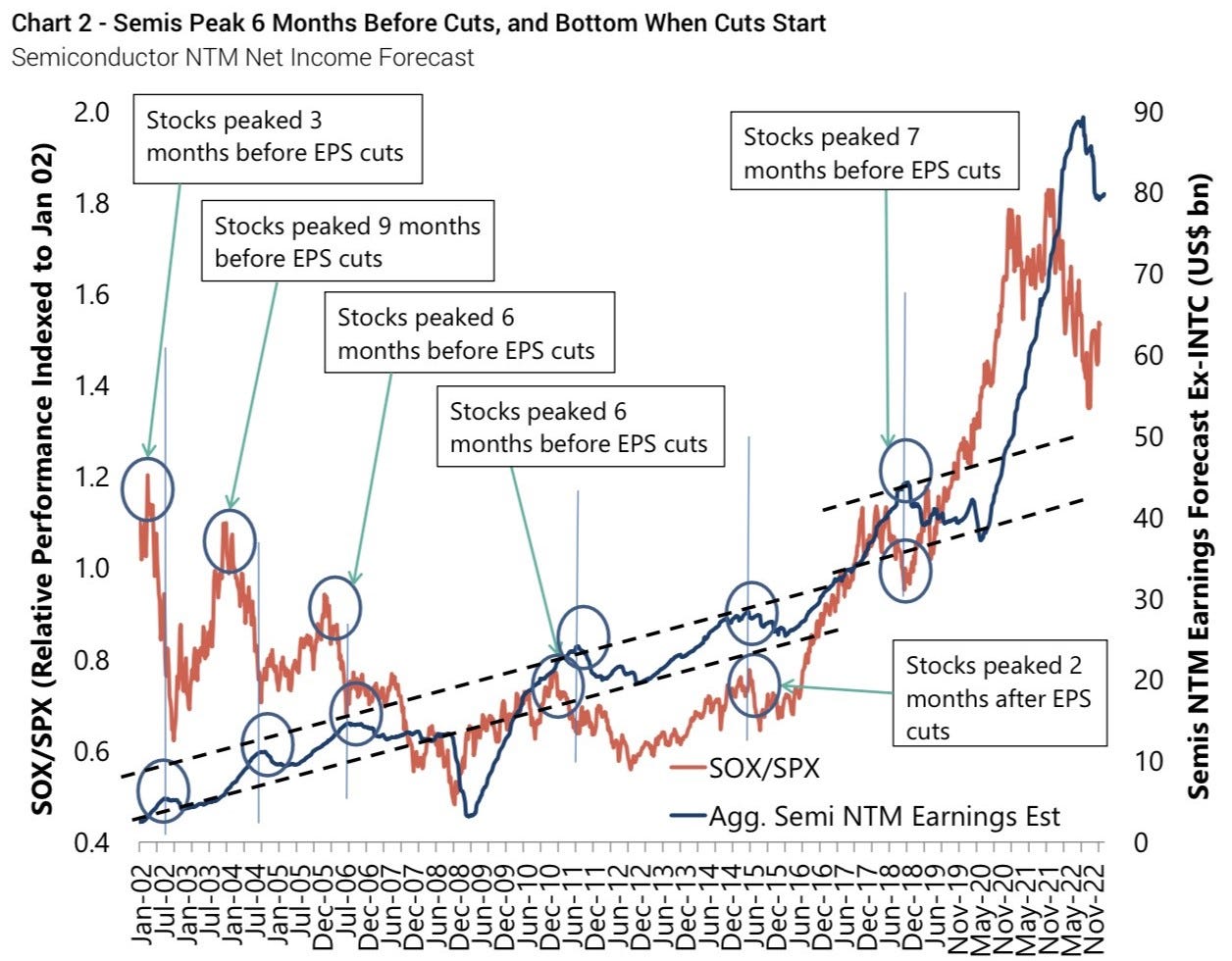

Public markets are generally quite sophisticated regarding trading equities of semiconductor companies. A year ago, semiconductor companies' stocks collapsed despite massive shortages in many end markets. At the same time, company management teams for many of these firms continued to say that business was robust and saw no decline on the horizon.

The reality was much grimmer, and business did slow down. Like every other major semiconductor downturn over the last few decades, the public market valuations of all the semiconductor companies started to come down ~6 months before the industry experienced revenue and earnings declines.

We can fault Wall Street for A LOT of things, but its ability to project declines in the semiconductor market before the industry is impressive. Nowadays, no one questions the downturn, and secular shortages only exist in extremely niche pockets such as silicon carbide power electronics.

The most intriguing aspect of Wall Street's behavior is that if we examine every period of industry decline over the past several decades, we see that stock prices reach their lowest point when the industry only starts to experience a fall in earnings, well before the trough of earnings. The stocks were already recovering and surging by the time layoffs and consolidation occurred.

This is no different in this cycle; over the last three months, the primary semiconductor ETF, $SOXX, is up 37%. This is a tremendous rebound, as earnings cuts are only getting started.

Wall Street is getting ahead of itself and trading on historical norms rather than the business fundamentals over the next year. They raced to call the bottom of the market, but they cannot fathom a cycle deviating from that norm. This norm will be tested and broken as this cycle will be longer than ~6 months.

Days of inventory are currently at all-time highs. Even higher than the Dot-com bubble and the 2008 financial crisis. This inventory will take a lot longer than two quarters to digest. While companies want to hold higher inventory levels to avoid future supply chain disruptions, this growth level is unsustainable. Clearing these record inventory levels will take low utilization rates for more than a few quarters. Days of inventory will keep growing in the Q4 quarter for nearly every company based on our channel checks.

Firms like UMC are already at 70% utilization rates, their lowest since the Dot-com bubble, but inventory levels have yet to start to fall. Furthermore, the market dynamics are very different from prior cycles regarding capacity additions. A tremendous oversupply of certain process technologies will depress pricing and margins for the medium term. Some foundries are even forcing their customers to take mountains of inventory, but this trend will revert soon.

The ~37% increase in semiconductor equities is based on the belief that the semiconductor down cycle bottoms in Q2 2023, but this would only make sense if the current down cycle was typical.

It is not. There is a significant downside for many firms, especially with some whose inventory hasn’t even started to grow yet, as they stuffed their end channel partners instead. That channel stuffing is extreme and will exacerbate the days of inventory problems even more as revenue slows.

Companies and investors in the space alike should track inventory and revenue deacceleration at suppliers and end markets to see if inventory is stuffed in hidden parts of the supply chain (it is). This investigation must be thorough to ensure the channel has begun to clear. In most parts of the industry, channel clearing has yet to start. The bright side is that the inventory is already clearing in small pockets of the industry.

Now onto our detailed data that helps dissect which of the 71 companies have high levels of inventory, and their growth or decline.

The companies covered are SK Hynix Inc - 000660.KS, Samsung Electronics Co Ltd - 005935.KS, Seoul Semiconductor Co Ltd - 046890.KS, Acer Inc - 2353.TT, Asustek Computer Inc - 2357.TT, Mediatek Inc - 2454.TT, Vanguard International Semiconductor - 5347.TT, Renesas Electronics Corp - 6723.JP, Semiconductor Manufacturing - 981.HK, Apple Inc - AAPL 0.00%↑, Analog Devices Inc - ADI 0.00%↑, Advanced Energy Industries - AEIS 0.00%↑, Applied Materials Inc - AMAT 0.00%↑, Ambarella Inc - AMBA 0.00%↑, Advanced Micro Devices - AMD 0.00%↑, Amkor Technology Inc - AMKR 0.00%↑, Alpha & Omega Semiconductor - AOSL 0.00%↑, Arrow Electronics Inc - ARW 0.00%↑, ASML Holding NV - ASML 0.00%↑, ASE Technology Holding - ASX 0.00%↑, Broadcom Inc - AVGO 0.00%↑, Avnet Inc - AVT 0.00%↑, CDW Corp - CDW 0.00%↑, Ceva Inc, Coherent Corp - COHR 0.00%↑, Cohu Inc - COHU 0.00%↑, Wolfspeed Inc - WOLF 0.00%↑, Cirrus Logic Inc - CRUS 0.00%↑, Dell Technologies - DELL 0.00%↑, Diodes Inc - DIOD 0.00%↑, Globalfoundries Inc - GFS 0.00%↑, Himax Technologies Inc - HIMX 0.00%↑, HP Inc - HPQ 0.00%↑, Intel Corp - INTC 0.00%↑, Inphi Corp, KLA Corp - KLAC 0.00%↑, Kulicke & Soffa Industries - KLIC 0.00%↑, Logitech International - LOGI 0.00%↑, Lam Research Corp - LRCX 0.00%↑, Lattice Semiconductor Corp - LSCC 0.00%↑, Microchip Technology Inc - MCHP 0.00%↑, Monolithic Power Systems Inc - MPWR 0.00%↑, Marvell Technology Inc - MRVL 0.00%↑, Micron Technology Inc - MU 0.00%↑, MagnaChip Semiconductor Corp - MX 0.00%↑, Maxim Integrated Products - MXIM 0.00%↑, National Instruments Corp - NATI 0.00%↑, NVIDIA Corp - NVDA 0.00%↑, NXP Semiconductors NV - NXPI 0.00%↑, ON Semiconductor - ON 0.00%↑, Impinj Inc, Photronics Inc, Qualcomm Inc - QCOM 0.00%↑, Qorvo Inc - QRVO 0.00%↑, SiTime Corp - SITM 0.00%↑, Silicon Laboratories Inc - SLAB 0.00%↑, Super Micro Computer Inc - SMCI 0.00%↑, STMicroelectronics NV - STM 0.00%↑, Seagate Technology Holdings - STX 0.00%↑, Skyworks Solutions Inc - SWKS 0.00%↑, Synaptics Inc - SYNA 0.00%↑, Teradyne Inc - TER 0.00%↑, Tower Semiconductor Ltd - TSEM 0.00%↑, Taiwan Semiconductor Manufacturing Company - TSM 0.00%↑, Texas Instruments Inc - TXN 0.00%↑, United Microelectronics Corp - UMC 0.00%↑, Veeco Instruments Inc - VECO 0.00%↑, Vishay Precision Group - VPG 0.00%↑ , Western Digital Corp - WDC 0.00%↑, Wolfspeed Inc - WOLF 0.00%↑, Xilinx Inc - XLNX 0.00%↑