Real estate has fledged recently in China under new restrictions. Various local governments have put in various measures to prevent real estate speculation. These measures include halting private equity investment, restrictions on property activities such as gifting, increasing interest rates, and holding local governments accountable for using the property sector as stimulus or rapidly rising hosing costs. This is causing carnage in the real estate market which makes up roughly 30% of the country’s GDP. These policies are meant to reign in this sector, but it is spilling over elsewhere.

Sales of homes are down over 60% for secondhand homes and 25% for new homes. Prices have also more than halved. There are even pictures and videos circulating on Chinese social media showing retail investors in a panic. Those who have lent money to Evergrande, the county’s 2nd largest property developer, crowding the debt-ridden real estate developer's offices in multiple regions.

Many would think that this is ok because real estate developers and agents are the ones losing out, but the average person wins due to falling housing costs. The issue with that is that over 90% of Chinese own their own home. When they see the value of their home is in free fall, but their mortgage doesn’t budge, they get nervous. Nothing gets people to have kids and consume more than telling them their home is worth half what they paid for it a year ago and their mortgage is underwater.

This carnage isn’t limited to the real estate industry. China’s PMI data looks very rough. PMI is the purchasing managers index and is leveled at 50 which means it is staying the same. This number summarizes market conditions from the view of purchasing managers. The manufacturing PMI has falled to 50.1 which means basically flat, while non-manufacturing PMI has fallen to 47.5, indicating non-manufacturing sectors are contracting.

Okay SemiAnalysis, that’s good to know, but what does this have to do with semiconductors!

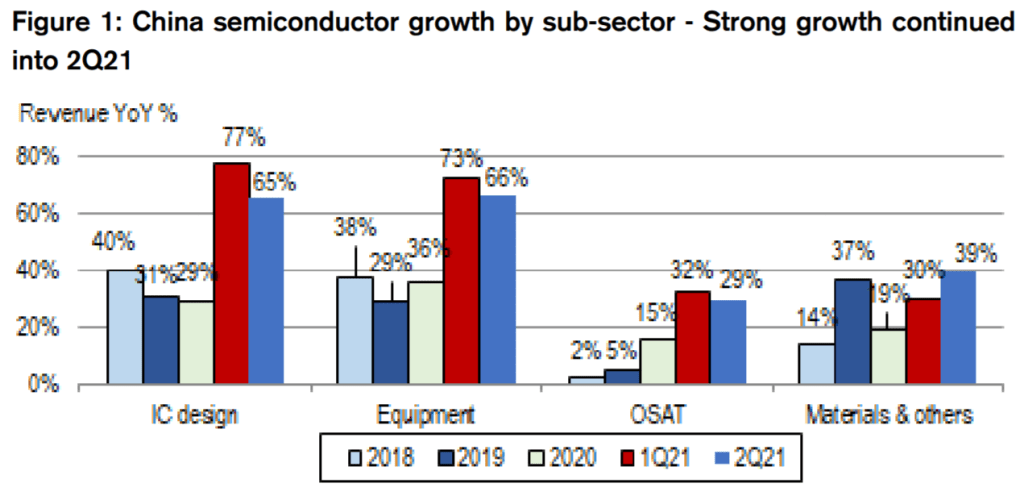

China makes up over 30% of new semiconductor capital equipment and it is accelerating. For example, Tokyo Electron, a major equipment provider for manufacturing semiconductors, had over 36% of new equipment sales. China is also a massive market for end user demand. If consumers are discouraged, they will consume less. One such example is in smartphones. Total domestic sales from January to July totaled ~203M units. In comparison to 2018 or 2019 data, this is down significantly.

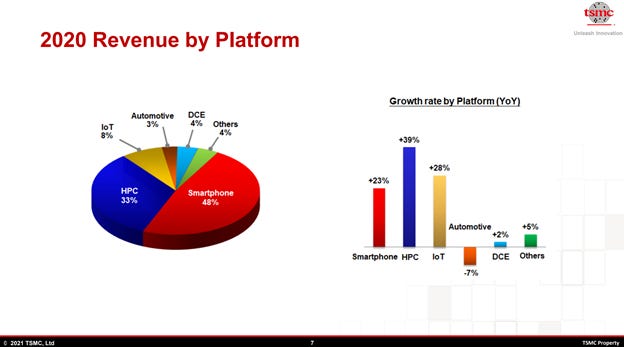

Fine and dandy you might say. “Smartphone sales are weak, but those aren’t really in shortage. Smartphones are available at reasonable prices in stores nearby.” While these aren’t the components that are causing all the headlines for shortages, they are the largest individual semiconductor market. TSMC receives roughly half of their revenue from smartphone chips after all.

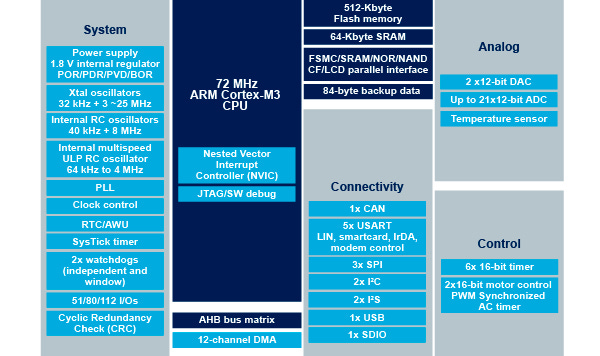

Weakness here would mean excess capacity would be generated and could be regeared for other areas. And the largest smartphone market in the world is clearly weak. This weakness isn’t limited to just smartphones in China. Reports show microcontroller pricing is falling in China. In early September alone, a common STMicroelectronics controller has fallen from ~$49.60 to $42.62.

Some of it is self-induced as well. China is trying to reign in the electric vehicle sector as well. Regulators are considering setting minimum production capacity utilization rate requirements. Those provinces that do not meet this will not be allowed to approve new electric vehicle production projects until surplus capacity is utilized.

So will this end the chip shortage?

No. Not Yet. Only if the Chinese economy continues to slide. Sorry for clickbaiting the headline, but Betteridge's law reigns supreme.

That microcontroller listed above is still being gouged. It is multiple times higher than the normal price with lead times over 30 weeks according to our conversations with a STMicroelectronics supply chain manager. Intermediaries are taking the supply they get and setting prices so high that they destroy demand.

Most other microcontrollers are still tight and some have lead times over a year. The semiconductor shortage isn’t anywhere close to over, but it does look like some elements are becoming less outrageous. Even once the gouging ends, the industry should be prepared for a new normal of higher prices and larger inventory builds. Foundries and design houses are still increasing prices for next year. They wish to keep growing their margins despite recognizing that smartphone sales in china are weak.

As long as book to bill rations remain above one, it’s party time for the supply chain, but the stocks will move well before those changes. Some firms will have stock price corrections this year, others will be poised for multi-year growth and can still increase from current prices. SemiAnalysis is helping our clients to navigate these choppy waters, but we advise public investors to be careful and do research or else you will be swallowed by the waves and eaten by sharks.