China and USA Are Officially At Economic War – Technology Restriction Overview

New regulations will impact global trade by hundreds of billions of dollars annually.

Today the US government levied new export regulations and restrictions against China that amount to a full-scale bilateral economic cold war. We will break down the impact and affected companies, but the actions were a long time coming. China intensified its covert economic warfare in the last decades through state-sponsored corporate espionage, state-sponsored hacking, dumping, and draconian restrictions for market access. The US is now responding with its salvo of restrictions to market access in semiconductors, telecommunications, optics, and AI.

There were two main sets of regulatory actions taken today. The first is a new ruling on new export controls for advanced computing, semiconductor manufacturing, and the general semiconductor supply chain. The other is adding 31 companies to the unverified list and modifying how companies on the unverified list must be treated. Both these changes will shift the landscape of technology and industry and reduce global trade by hundreds of billions of dollars a year.

The summary is that the US is forcefully decoupling the entire advanced technology supply chain before China insources it. Advanced logic, such as AI and HPC chips, are restricted. Equipment for 16nm or more minor logic chips, non-planar logic chips include FinFET and Gate All Around, NAND with 128-layers or more, and DRAM with 18nm half-pitch or less are restricted. Specific equipment bans go further and limit many even older technologies. Many major Chinese companies and universities will no longer have access to the American supply chain, which includes practically every large company in Europe, Japan, Taiwan, South Korea, Singapore, and India.

First, we will discuss the unverified list. At first glance, it seems like a small change, but it gives the US Bureau of Industry and Security (BIS) the unilateral ability to cut any Chinese company off from global supply chains in 2 months as long as the current business and regulatory laws of the Chinese Communist Party remain in place.

The unverified list is sort of a precursor to the entity list. The entity list is used on people and companies supporting or engaging in terror acts. This includes enhancing the military capabilities of governments that have repeatedly supported international terrorism. The list is also for transferring, developing, servicing, repairing, financing, supplying, or producing weapons in a manner that is “contrary to United States national security or foreign policy interests.”

The most well-known use of the entity list is Huawei. They were placed on the list for breaking sanctions and cooperating with Iran years ago. While this was the official justification, the open secret is that it was due to Huawei’s market share in telecommunications equipment. This was especially concerning for the US government due to the backdoors they claimed to have found in that equipment which would grant China access to worldwide internet traffic due to the national security law in China and Huawei’s deep ties to the PLA. If Huawei were not placed on the entity list, its worldwide market share of total telecommunications networks for 5G would easily be above 60%.

The entity list was the big stick that blocked Huawei’s access to the US market and subsequent supply chains built off US technology. These supply chains include TSMC’s fabs, which use various US tools and software.

The unverified list is a pre-cursor because it is for persons and companies that the US cannot verify as having broken the rules. A significant change with the new unverified list is that companies on the list cannot be exported after November 7th unless an export license is granted which effectively kills access to the US and global supply chian. The list includes various industry titans, universities, and government agencies.

On the industry side of things, the biggest name on the unverified entity list is Yangtze Memory Technologies Co. We have discussed YMTC extensively, including an in-depth report on their latest process technology compared to other firms. As a reminder, they have fabricated denser NAND than every other company, including Micron, Samsung, SK Hynix, Western Digital, and Kioxia, through their innovative Xtacking technology based on licensed technology from Adeia. It’s interesting that CXMT, China’s DRAM champion, and SMIC, China’s logic champion, were not included despite their DRAM and logic being used more extensively throughout the Chinese military and high-performance computing industries.

Another noteworthy mention is Beijing Naura Magnetoelectric Technology Co. Given that is a subsidiary of the larger Naura and the US government’s history of typos, we assume this is Bejing Naura Microelectronics Technology Co. Further proof is that the address on the regulation matches the parent Naura. Naura is a partially state-owned enterprise that is China’s largest semiconductor fabrication equipment company. They generated more than $2B of revenue across the last 12 months from tool sales in various industries, primarily semiconductors. The US government is effectively firing a salvo at the Chinese equipment space. While a few other small equipment companies were included, the other most prominent players, such as ACMR, AMEC, E-Town, Piotech, Chang Chuan, and Huafeng were not included on the list. The full list is in the regulation, but it included some major academic institutions as well as a variety of firms.

The other biggest change is that the criteria for addition to this list was expanded.

With this final rule, BIS also clarifies the activities and criteria that may lead to the addition of an entity to the Entity List, including a sustained lack of cooperation by the host government (e.g., the government of the country in which an end-use check is to be conducted) that effectively prevents BIS from determining compliance with the EAR.

Because the Chinese government does not allow US auditors, public or governmental, this effectively gives the regulators the toolbox to crush any company they decide to.

Let us repeat in more direct wording.

Any company in China can be cut off from worldwide supply chains in just two months by being added to this list through the justification that China does not cooperate with the US Bureau of Industry (BIS) and Security.

Unless China changes its rules and regulations regarding auditing, this alone is a nuclear salvo.

Moving onto the central export control that everyone is discussing surrounding advanced computing and semiconductor manufacturing. This huge change affects vast swaths of the industry, and there are many details that others haven’t reported on yet that we want to cover. To summarize, it covers all advanced chips that could be used for AI and supercomputing. It also covers equipment that can be used to manufacture them.

The core criteria given is anything that can process and analyze data that can help improve the speed, accuracy, planning, logistics, autonomous military systems, cognitive electronic warfare, radar, signal intelligence, and jamming of the Chinese military. The regulation is very upfront about China and its human rights record.

In addition, advanced AI surveillance tools, enabled by efficient processing of huge amounts of data, are being used by the PRC without regard for basic human rights to monitor, track, and surveil citizens, among other purposes. With this rule, BIS seeks to protect U.S. national security and foreign policy interests by restricting the PRC’s access to advanced computing for its military modernization, including nuclear weapons development, facilitation of advanced intelligence collection and analysis, and for surveillance.

On the manufacturing side, the purpose of the ban was also laid out with similarly clear wording.

However, semiconductor manufacturing equipment can also be used to produce various ICs (packaged or unpackaged) for WMD or other military applications, as well as applications that enable human rights violations or abuses, including but not limited to the advanced systems and “supercomputers” described above. Similar to their use in commercial products, the use of semiconductors has become vital in the “production” of military systems, particularly for advanced military systems, and may be used for purposes that are contrary to U.S. national security and foreign policy interests. The PRC government expends extensive resources to eliminate barriers between China’s civilian research and commercial sectors, and its military and defense industrial sectors. It also is developing and producing advanced integrated circuits (packaged or unpackaged) for use in weapons systems.

While US law forbids American people and companies from assisting with these use cases, it has only been enforced them when the U.S. government had clear knowledge of activities that contribute to prohibited end uses. Due to the amount of state control and “military-civil fusion,” US people and companies are now expressly prohibited from working in these areas, even if they have no direct knowledge that the work is for prohibited use cases such as missile programs. This effectively locks American people out of working in the Chinese technology industry for advanced logic, NAND, and DRAM, which could potentially be used for those applications. In addition, if a firm uses US-origin technology or software, this regulation applies to them through the direct product rule. These technologies and software include EDA and semiconductor manufacturing equipment.

It is necessary and consistent with the Export Control Reform Act of 2018 (ECRA) to impose this “U.S. persons” activity control under the EAR for ‘support,’ including the provision of services and foreign-produced items not subject to the EAR, but capable of producing such integrated circuits (e.g., advanced logic, NAND, and DRAM integrated circuits). With this rule, BIS intends to limit the PRC’s ability to obtain semiconductor manufacturing capabilities to produce ICs (packaged or unpackaged) for uses that are contrary to U.S. national security and foreign policy interests.

Advanced logic falls under two categories. The first is for chips that can be used in AI and HPC. First is the Advanced Computing Integrated Circuit controls. This applies to the entirety of China. The test is per chip. Every export to China, even to a subsidiary of a US company, is covered. That test is for chips with both 600 GB/S IO and [4800 (PERF*Bit length) or 600 TOPS PERF]. Under this definition, Nvidia’s A100, H100, AMD’s MI250X, Biren’s BR100, Graphcore’s BOW, Cerebras’s WSE, and more apply.

The other ruling is for supercomputers. It applies to all semiconductors being sold to 28 parties on the new supercomputer entity list. It also applies to any system that would meet the new supercomputer definition of 100 or more double-precision (64-bit) petaflops or 200 or more single-precision (32-bit) petaflops within 41,600 cubic feet or 6,400 square feet.

For reference, this means the Summit supercomputer, built in 2017 and occupies 5,600 square feet, is near 3x the supercomputer requirement due to its lower floor space and Rpeak double-precision performance of 200 PFLOPs. These regulations would mean not only are Nvidia’s current generation A100 and H100 banned, but also the 5-year-old V100 GPU as well. Using standard server racks with 8Us dedicated to networking and storage and 34 for compute, a system with only AMD Genoa CPUs would also fall under the classification of supercomputer despite the lack of accelerators. The government regulations are very vague on this, but one could easily argue that this means Genoa is banned because it could be made into a high-peak PFLOP supercomputer. The same sort of test would apply to a supercomputer made of Nvidia’s highest-end gaming GPUs due to their high FP32 performance.

The regulation includes chips fabbed outside the US but using American tools and EDA software, so TSMC cannot work with China’s fabless players on this either. For example, China’s AI chip champion, Biren, whose staff includes many ex-Nvidia employees, would be banned due to its FP32 performance. If this is the case, companies like AIChip from Taiwain could lose almost all of their business outside of Amazon. Many restrictions were outlined that called for licenses for certain kinds of microcontrollers, analog chips, superconducting devices, and sensors.

The other category of restrictions surrounds manufacturing. While EUV is still not allowed in China due to the lack of Dutch export licenses, this new regulation adds a new layer of restrictions. Equipment for logic circuits using non-planar architectures and any process node at 16nm or less are all banned. This means no tools can be shipped to China for a relaxed FinFET or Gate All Around transistor.

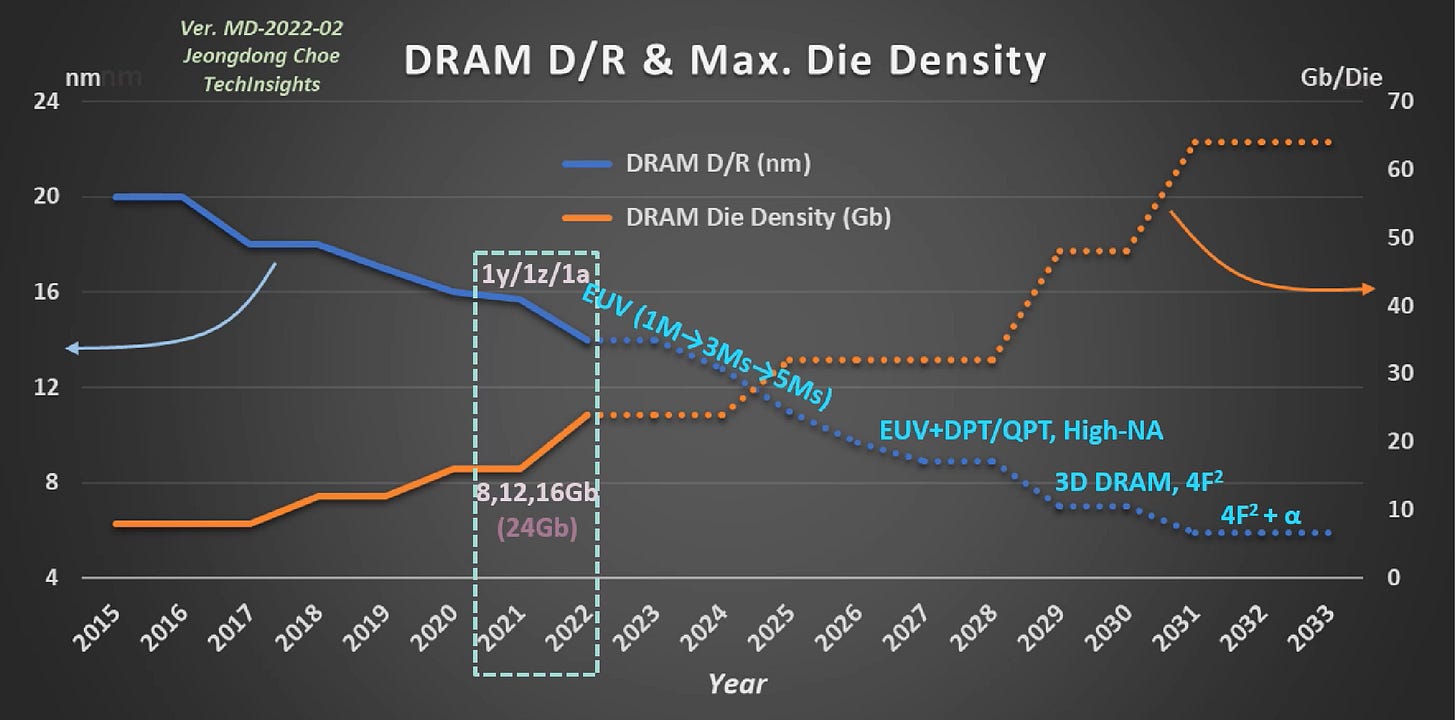

Furthermore, NAND equipment is banned for processes with 128-layers or more, and DRAM equipment is banned for 18nm half-pitch. On the DRAM side of things, this presumably means China is stuck at 2016 technology.

The problem with these restrictions is that there is no such thing as equipment for 16nm or less or NAND equipment suitable for less than 128-layers, but not more. For example, a 5nm node could be made entirely with DUV tools, even if it isn’t economically viable. A 232-layer NAND node could be made with the same tools as a 64-layer NAND node. There were no details such as overlay accuracy for lithography or selectivity regarding etch and deposition, so this is a very blurry line. It will be near impossible for regulatory actions to be consistent, which puts companies and the US government in a tough place.

In the past, below 14nm was banned, but they handed out export licenses like candy. Now the US government is sticking to their guns and deeming any equipment used for more advanced processes banned. This could mean that even 64-layer NAND, 28nm logic, and 20nm DRAM processes could be banned due to the possibility of those tools being used on newer process technologies.

Due to this ambiguity, the US government laid out two dozen pages of specific tool categories that would not be allowed. This targets almost all sectors of the wafer fabrication industry and is very broad. Some of these restrictions are so broad that we believe they would cripple much less advanced semiconductor processes, not just the advanced ones specifically called out. One of the banned tool types specified in the regulations can be found in some IBM process nodes as far back as the late 1990s. A process engineer friend joked with us that it feels like some tech interns Google’d papers and copy-pasted the experimental section.

These restrictions will hit all major equipment firms, including Applied Materials, Tokyo Electron, Lam Research, ASM International, KLA, Onto, Nova Measurements, ASML, and more, although to varying degrees. The biggest negative is that the foreign direct product rule does not apply to specific tool bans, only entity list firms and process technology levels, so this could lead to firms like Tokyo Electron and ASM International gaining share in the long term. Lam Research will be the most immediately impacted due to the YMTC ban costing them ~7% of their revenue.

Some other limited categories outside the major process categories include epitaxy tools, tools designed for III-V and II-VI semiconductor materials such as Gallium Nitride used in power semiconductors, Indium Phosphide for photonics and high-frequency applications, GaA, and other niche materials. Oddly nothing on silicon carbide despite it being much larger and directly IP that Wolfspeed, a US company, invented. Many forms of ebeam and focused ion beam tools are also limited. Many segments of mask infrastructure, from blanks through to processing equipment and processed masks, are also limited.

The Bureau of Industry and Security (BIS) stated they would review all license applications under the presumption of denial based on national security risks, foreign policy interests, and human rights. The BIS did state that they would grant one exception to the presumption of denial. That is for semiconduction manufacturing designed for end users located in China that are headquartered in the US or other countries (the list was mostly US allies). These exceptions would be reviewed on a case-by-case basis instead of under a presumption of denial. The purpose of this inclusion is likely as a bone to South Korea. We discussed this in detail a couple of months ago regarding the Chip 4 Alliance, and due to our excellent sources, our reporting and analysis turned out to be spot on. In short, SK Hynix DRAM and NAND fabs and Samsung’s NAND fabs in China will still be able to operate.

Tool restrictions start this year for Chinese firms. A temporary license was already granted for firms from friendly countries operating in China until April 7th, 2023. These firms can apply or move operations out during that brief period. We believe South Korea will have to agree to join the Chips 4 Alliance for Samsung and SK Hynix to receive longer-term licenses.

With all that said, there were hundreds of restrictions we did not detail in this article, and we are not international trade lawyers. We encourage you to read the source regulations as many details are included. There seem to be a few loopholes and massive issues regarding actual enforcement. Regardless, the language in the regulations is a very aggressive countermeasure to China. Chinese fabless companies can still access the foundry industry outside of China, and companies like Biren don’t seem to be directly banned. We’d imagine that these fabless firms, the rest of the equipment space, and players like CXMT and SMIC would be the next shoe to drop.

PS, if you are at OCP or in the Bay Area over the next couple of weeks, let us know, would love to get coffee.