Semiconductor Roundup – 2/1/2022

AMD, NXP, Google, KLIC, Cirrus Logic, Entegris, SK Hynix, Lasertec, Rohm, Fabrinet

This will be our third post of this type for the flurry of semiconductor earnings releases and calls that are happening now. In the first post, we covered Teradyne, Lam Research, Wolfspeed, Texas Instruments, UMC, Intel, Xilinx, Samsung, and MediaTek. In the second post, we covered Tesla, Apple, KLAC, MKS Instruments, MACOM Technologies, Silicon Motion, and STMicroelectronics. These are almost required reading because the most interesting parts of these roundup posts are what you can read through about other firms in the supply chain that sometimes are seemingly even unrelated. Some themes in the previous post will continue on, but others will not. In this post, we cover Google, NXPI, Kulicke and Soffa Industries, Cirrus Logic, Entegris, AMD, SK Hynix, Rohm, and Fabrinet.

Turning to CapEx. The results in the fourth quarter primarily reflect ongoing investment in our technical infrastructure, most notably in servers, to support ongoing growth in both Google Services and Google Cloud. We also increased the pace of investment in fit-outs and ground-up construction of office facilities.

In 2022, we expect a meaningful increase in CapEx. In technical infrastructure, servers will again be the largest driver of spend.

I don’t need to say anything, only link this.

2022 is shaping up to be a +25% datacenter spend year across hyperscaler and enterprise, with hyperscalers leading the charge. This spend will incrementally mostly go to AI and networking.

NXP Semiconductors

This is one that I think sell side has completely wrong. There’s a couple sell/downgrade ratings even from terrific analysts such as Stacy Rasgon. NXP isn't big into the power semi and battery world, but they are embedded in so many other applications and usecases. The beat was strong, guidance was terrific.

We anticipate 2022 will be another year of demand/supply imbalance with lead times extending out across almost the entire portfolio and the level and intensity of supply-related escalation conversations with our customers remains elevated.

Q1, very clearly, and I just want to be very explicit here relative to the guidance, this is completely kept by available supply, so much more demand than what we have in terms of supply.

Don’t know how one can get more bullish than this.

Kulicke and Soffa Industries

Earnings is later this week, but I am pessimistic. There’s a triple whammy here. Let’s not forget the CEO sold a lotta stock recently…

China lockdown. Lam Research and KLA have had huge issues getting deliveries to China, part of that is pushing revenue out to the next quarter.

KLIC order terms are not favorable. Because where they sit in the supply chain and their customers, they have worse terms for orders and deliveries. LAM and KLA can recognize revenue at shipment or delivery, KLIC almost always recognizes revenue at delivery. Any hiccup here hurts hard. The China issues will push on KLIC far harder, so I expect this issue to be exacerbated here vs the front-end semi-cap.

Wire bond temporary saturation. There are over 10 OSATs with >$100M revenue, so it is hard to judge the market, but looking at the 3 largest, ASE, Amkor, and JCET, they are scaled back wire bond orders significantly in Q4. ASM Pacific, the number 2 in wire bonding, also expects a slowdown of wire bond orders in Q4. KLIC trades on the order book right now, for a variety the of reasons, investors do not care about the cash on hand or buyback story. Investor don’t care about miniLED, TCB for photonics, or the battery business. We do expect wire bonding orders to reaccelerate at some point this year because capacity is not anywhere close to ready for the flood of trailing edge semi coming online, but for current fabs, we have plenty of capacity at Tier 1 OSATs and Tier 2’s/3’s are somewhat overbuilt.

That said, the stock is very cheap so movement expectations from earnings are a crapshoot.

Cirrus Logic

Heavy Apple supplier here and they crushed earnings as expected with the strong Apple beat and business there. It’s very seasonal, but the beat is a pull in. Note they are not guiding a June quarter. Everything probably equalizes in the end. Such is life for Apple suppliers.

So in fact, when we look at the March quarter, it doesn't look like a typical seasonal quarter – seasonal step down from December to March. It looks very strong. We're actually pulling material into the current quarter, wherever we can, in order to try to meet customer demand.

Interesting read through on Apple supply chain. Was part of STMicro’s beat/guide also a pull in of Apple orders? They didn’t say it, but could be.

Entegris

Crushed it on earnings and outlook. They don’t have as many supply chain issues as many others. Entegris is mostly leveraged to wafer volume, but they do have a bit more leverage to shell capacity as well. This contrasts with traditional semicap names which are based on actual tool spend. As shells get built out with Samsung, TSMC, Intel, and many others not having much empty clean room space, they will benefit heavily. Wafer volume is going to only go up from here. Any down cycle would involve too much capacity coming online, and folks undercutting each other to maximize utilization for equipment they already bought. They should continue to grow revenue at slightly above wafer volume.

AMD

They beat yet again. Fairly boring quarter. The important things to note are that they are guiding nonGAAP gross 51% for 2022 vs Intel’s is indicative of 51%-53% for the year with 52% in Q1. When you stack on the Xilinx acquisition, this means they will surpass Intel on gross margin.

Q1 guide is $5B while year guide is $21.5B, so the typical seasonality and growth just isn’t there. AMD is completely sandbagging in my opinion. AMD will significantly beat on the 51% gross margin guide when you look at the shift in mix and price increases, they are forcing through on datacenter. They probably exit the year at 54% gross margins.

AMD paid down $1B prepayments this quarter, versus the over $3B that Nvidia did with more on the way. AMD also did $756M of buybacks in Q4. Kinda wish they didn’t do those and just threw that money all at more supply, because they will sell everything they make anyways. On the other hand, year to date, AMD has done $1B of buybacks, and those are likely working wonders as the stock cratered for factor reasons and now is coming back up to where it should be.

AMD will beat their year guide, by how much is contingent on supply. With continued N7/6 ramp and ramping up to 20k WPM of N5 next year as well, there is sizable room for beats in my opinion. Remember they guided 35% for 2021 and we got 68%.

AMD is trading kinda…. cheap. Then again, I am saying $5.1 EPS which is way above consensus by nearly a full dollar. That number is pre-Xilinx dilution. Xilinx is dilutive, and by a lot. I continue to say it, but I hate that deal…. Lisa Su gets a free pass to do whatever she wants, she clearly is much smarter than any of us.

SKHynix

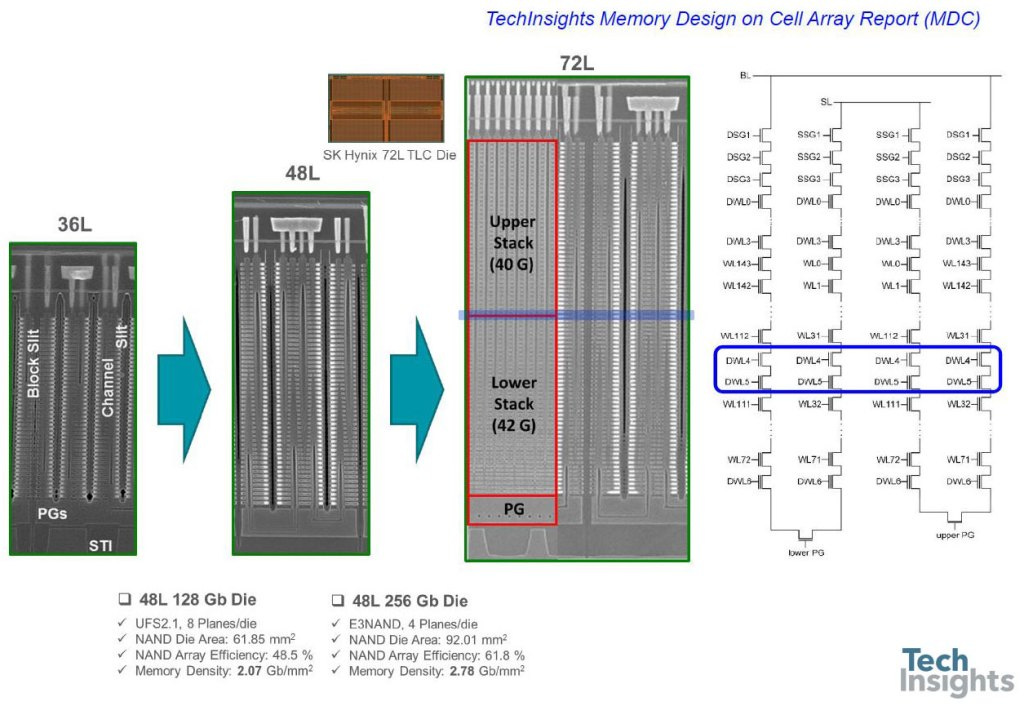

Love SKHynix calls because they tell you all the numbers with node transitions and sub-segments. It’s great!

SKHynix continues to gain share in NAND. I have to imagine their long-term plan is to surpass Samsung in NAND market share. I would be flabbergasted if Samsung allowed that. A big spree of capex probably gets announced by Samsung in March.

An interesting conundrum in the background of this report is SKHynix 1A DRAM transition. They cannot ramp their China fab with this node due to 1A inserting EUV and export licenses for EUV tools to China having not been granted yet.

SK Hynix is in the same camp as Intel and AMD in that PC sales are flat year over year with mix getting much better due to Chromebook falling off the face of the planet and enterprise/gaming increasing. More interestingly, SK Hynix expects mobile to grow at mid-single digits. I can’t say I agree. I am more bearish on mobile units than SK Hynix is. Content will go up, sure, but they even mentioned the weakness in low end and midrange…

Overall, DRAM demand growth is expected to be in the 18% this year and we are aiming for the company's bit shipment growth to be in line with market growth. However, demand may soften in the first quarter due to seasonality, and we plan to respond more flexibly in light of our lower inventory level. Accordingly, the company's DRAM bit shipment in the first quarter is planned to decrease by mid to high single-digit Q-o-Q.

SK Hynix will grow their inventory levels in order to soften the impact of the weakness in the DRAM market. Samsung and Micron likely do the same and this should equalize pricing.

NAND demand growth this year is expected to be about 30% and the company is planning for bit shipment growth that outpaces demand growth again for the year. This is based on our existing NAND business, and when Solidigm's volume is included, bit shipment growth is expected to almost double compared to last year.

Prices for NAND continue to fall. They didn’t give a number, but based on our research it should be roughly in line with cost decreases as 70% of bit output transitions to 176 layer. NAND is a healthy market.

On the other hand, equipment spending is planned to be similar to last year and will remain below the annual depreciation

Makes sense with DRAM market under tight oligopolistic control and everyone having very low capex node transition from 128 layer to 176

The 176 layer NAND, which started mass production in Q4 last year, is based on the same tech platform as the 128 layer.

That is, except for Samsung. Samsung and YMTC are the hopes for NAND capex. Kioxia/WDC, SKHynix, and Micron already 2 deck for their 128 layer generation and 176 layer generation. These firms do not see a large increase in wafer starts either. Samsung was still 1 deck at the 128 layer generation which meant they had a cost advantage due to only having to do the long cycle time drill through etch and deposition steps once. As they move to their 176 layer generation, Samsung should have higher capex relative to others for the same increase in bit output. Those others had that capex intensity increase at 128 or 92 layer NAND.

But then, let's say, especially for SSD, in terms of the product reliability, I would say that the FG would be far superior than the CTF. So -- and also now, other companies are launching the QLC line up these days, but Intel has long been the leader in the QLC, and I would say that now Solidigm has the only technological base that would allow the launch of the PLC line up down the road.

Even though it has been telecasted in the past, I am sorta surprised that SK Hynix will keep running the Intel IMFT NAND nodes. There would be tremendous productivity increase and cost per bit decrease if they transitioned the Intel Dailan fab to SKHynix 176 layer.

We are currently planning to maintain the 2 technologies in parallel.

Lastly, SKHynix says they expect 3D DRAM in the late 2020’s. ASM International expects it mid 2020’s. ASML seems to also be more in the later camp. This is certainly interesting to see.

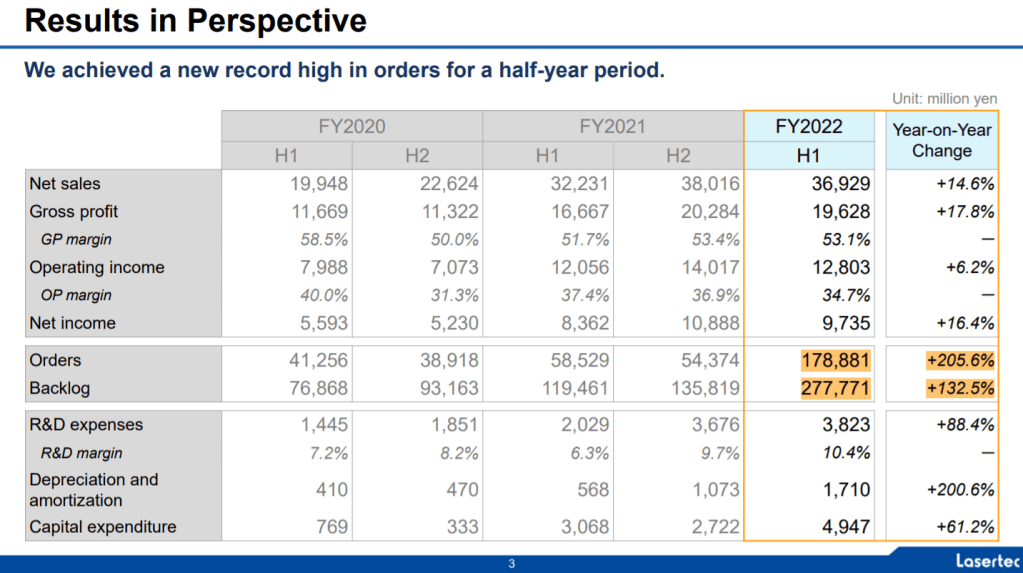

Lasertec

Lasertec absolutely crushed it on orders. They have a meaningful technology advantage over KLA within the EUV mask inspection world. Lasertec is essentially a levered bet on EUV.

KLA is scrambling to catch up to them in this subsegment and trying to hire like mad. Lasertec has a multiyear runway with their technology advantage.

We have been working on a new article about masks, mask making, and mask inspect. This discussion will be continued on there, so look forward to it.

This table is really good and highlights the difference in spend per node. Note the huge spend increase on trailing edge. The table is before TSMC threw down the capex gauntlet. At the time of this chart being made, Semi had them penned in at ~$36B, not $40B-$44B

Rohm

Not much to say here on the earnings. I just want to point out that they have the 2nd best SiC technology holistically from materials through to device and module. Unfortunately, they, just like II-VI, are too passive on the market. II-VI is a bit more aggressive despite their massive underinvestment in SiC, but Rohm is severely underinvesting. Rohm, if their management and culture had the stomach for it, could raise $1B+ and have an end to end platform from materials to modules that would trounce any of the traditional power semiconductor players such as Infineon, On, or STM. A boy can dream right?

In the subscriber only section, a bit on Fabrinet as it relates to last weeks subscriber only section short idea. I like the idea even more now.