The Impending Chinese NAND Apocalypse – YMTC 128 Layer NAND Is The First Semiconductor Where China Is Technologically Competitive

The NAND flash market has been doing quite well recently. Prices have risen nearly 80% from their lowest levels last year based on TrendForce’s spot prices. Combine Covid-19 with the resulting work from home PC and datacenter booms and NAND spot prices are extremely high. The PC market is starting to turn and phone sales are still weak, especially in China. SemiAnalysis wrote about the potential for the Chinese real estate meltdown ending the semiconductor shortage a week before Evergrande news became mainstream. These headwinds about a “memory winter” pale in comparison to the impending NAND apocalypse brought on by Yangtze Memory Technologies Company (YMTC). YMTC will have ~100,000 wafers per month of technologically competitive NAND production by early 2022. YMTC is currently at ~80,000 They are constructing their 2nd fab which would be another 100,000 WPM. Good for 6%-8% market share depending on the mix of process node and yield improvement curves.

The key aspect here is technologically competitive. Due to poaching a lot of South Korean engineers, YMTC’s progress has been nothing short of extraordinary. Tech Insights has torn down the 128 Layer TLC NAND that is currently shipping and ramping. They have found that not only do all of YMTC’s claims play out, but their process exceeds others with similar layer counts. In the same die area, they fit higher capacity than every other NAND process at the same number of layers. Similarly, they are not far behind on layer counts given the competition is only starting to ramp their next generation at the same time as YMTC is ramping 128L.

According to TechInsights, the array efficiency and memory bit density are considerably higher than conventional 3D NAND such as Samsung 128L V-NAND and Kioxia/Western Digital 112L BiCS5, Micron 128L CuA CTF, and SK Hynix 128L 4D PUC. For example, YMTC 128L 512 Gb die bit density is 8.47 Gb/mm2 which is higher than Samsung 128L 512 Gb die (6.91 Gb/mm2). Intel may stick out to others on this slide, but that is due to use of QLC. They do not seem to have a competitive NAND roadmap going forward as SK Hynix has purchased the Intel NAND operations.

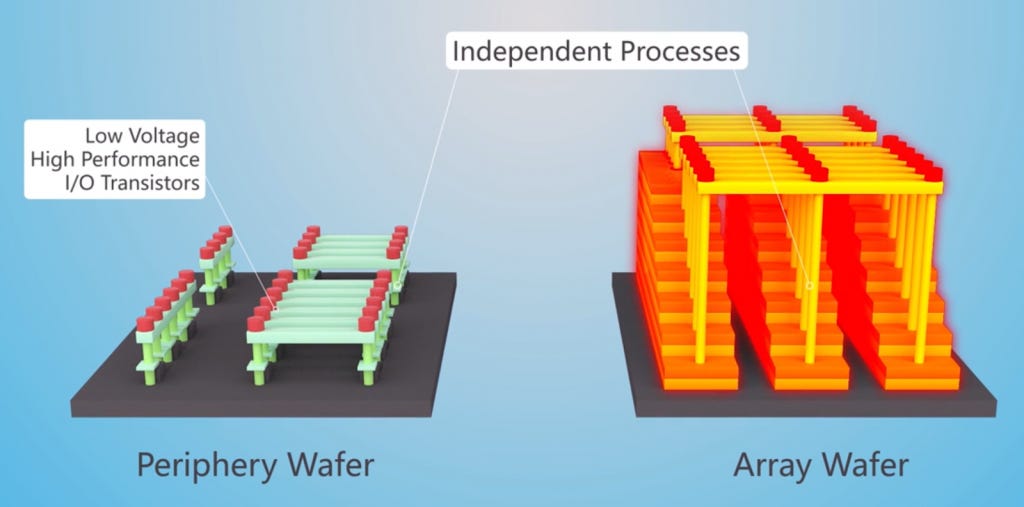

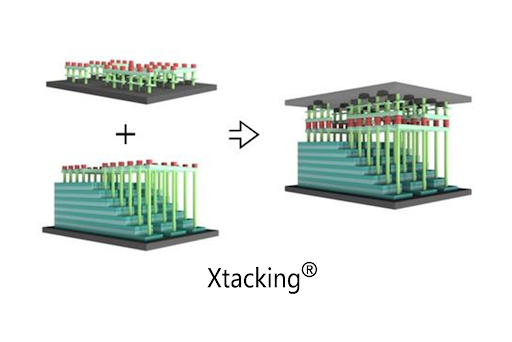

The high density is due to their innovative Xtacking architecture. For NAND, the periphery and array gates have quite different requirements. Fabricating them on the same wafer introduces compromises or requires more time to integrate. With Xtacking, YMTC fabricates the periphery on a separate wafer and uses wafer on wafer 3D bonding to package the two. In the case of Micron, SK Hynix, Intel, and Samsung, and Kioxia/Western Digital, the memory and periphery are all built on the same wafer. This achieves cost benefits by only having to use 1 wafer. However, it increases lead times for developing and ramping new process nodes. YMTC’s rapid transition to 128 layer NAND is partially due to the disaggregation of these two components.

The ability to rapidly match on technology will allow YMTC to ramp and take a sizable market share in a short timeframe. Grabbing 6-8% market share may sound insignificant, but it will be extremely impactful due to the elasticity of NAND demand. The NAND market shifts in price very quickly with as large as 3%-4% swings many weeks. The supply chain can react to increase demand, but this is a long process. Consumer electronics such as smartphones and laptops take months to react to these price changes and datacenter SSD spending has cycles of large purchases and digestion. Additionally, although competitors project growth out of the Wuhan based NAND fab, they are not prepared for how rapid the ramp in production will be.

It isn’t all rosey. YMTC still needs to fix their yield issues. Our sources indicate the 64 layer nand is near 85% yield and the 128 layer is below 50% currently. Many analysts and firms are projecting as low as 4% market share for YMTC. SemiAnalysis believes that they will be surprised with how quickly YMTC ramps and solves their yield issues. We believe YMTC will have 50% to 100% higher output than many in the industry are projecting. NAND fabs have large lead times and are massive capital expenditures. All this means the supply from other fabs cannot react instantly. As the Chinese NAND enters the marketplace, the market will not be prepared to deal with the fall out.

Once 128 Layer NAND fully ramps in the first fab and the 2nd fab begins ramping, YMTC will look to build a 3rd and 4th Giga-Fab. The turmoil surrounding the Tsinghua group have been brushed off fairly easily. The short-term pain is nothing compared to what will happen in the long-term. With the new cold war kicking off, the Chinese look to wean themselves off imports in critical areas. Due to this fear, there will be heavy investment into the domestic semiconductor industry via large capital investment and subsidies. China is even trying to clamp down on real estate investment to divert more capital to high tech.

The “Made in China 2025” goal requires 70% of semiconductors to be domestically produced. China will have an imbalance, and NAND helps corrects this imbalance. Logic will still be imported to a large degree, but with NAND, China will look to be completely self-sufficient. The largest market for NAND will no longer be a net importer in the long term. In short, the NAND market will have a lot of market turmoil due to this rapid shift from China.

We can already see the beginning of this shift. Lam Research makes the most semiconductor capital equipment for NAND. Lam Research’s China revenue now exceeds their Korea revenues. Korea has long been known to be the center of NAND with over half the world’s supply produced there. It will take time for total bit supply to shift, but the equipment trends have already started.

The apocalypse occurs with the current players. Early last year SemiAnalysis protected that there would be consolidation within the NAND industry. We didn’t think that this consolidation would happen so quick. Intel is selling their NAND business to SK Hynix, and Kioxia/Western Digital are likely attempting a merger. SemiAnalysis believes there is still more consolidation to go. Micron will have to lean more on DRAM, but they likely will also partner with an existing player on future node development. Our money is on partnering with Kioxia/Western Digital. We can’t be sure exactly how this plays out, but NAND will become a complete commodity in the semiconductor space. Investors should be wary of any further investment in this market.

This article was originally published on SemiAnalysis on September 28th 2021.

Clients and employees of SemiAnalysis may hold positions in companies referenced in this article.