Semiconductor Roundup – 2/10/2022

GlobalFoundries, Sumco, GlobalWafers, Power Integrations, FormFactor, Texas Instruments, Ichor, Ford, Kulicke and Soffa Industries, TSMC, Amazon, Skyworks, Qorvo, Qualcomm, Murata, Rambus, and Renesas

This will be our fourth post of this type for the flurry of semiconductor earnings releases and calls that are happening now. In the first post, we covered Teradyne, Lam Research, Wolfspeed, Texas Instruments, UMC, Intel, Xilinx, Samsung, and MediaTek. In the second post, we covered Tesla, Apple, KLAC, MKS Instruments, MACOM Technologies, Silicon Motion, and STMicroelectronics. In the third post, we covered Google, NXPI, Kulicke and Soffa Industries, Cirrus Logic, Entegris, AMD, SK Hynix, Rohm, and Fabrinet. In this post, we will cover TSMC January results, Amazon, GlobalFoundries, Ford, Kulicke and Soffa Industries, FormFactor, Texas Instruments, Power Integrations, Sumco, GlobalWafers, Ichor, Skyworks, Qorvo, Qualcomm, Murata, Rambus, and Renesas.

TSMC January Results

TSMC crushed it and was well above estimates with January coming in 10.8% above December and 35.8% year over year. Their guidance was 5.5% to 9.3%, so TSMC is already looking like they will beat their awesome Q1 guide on a revenue basis.

Amazon

If 75% of Amazon’s infrastructure spending is for AWS, then capital intensity is 35%... Wow

So when you look at those numbers and how they've grown over the last few years, I'll give you the proportions, which I'm not sure we've initially shown before is about 40% -- just under 40% of that CapEx is going into infrastructure, most of it's feeding AWS, but also certainly, Amazon is a large customer of that as well as we build infrastructure for ourselves directly or through AWS.

Amazon keeps increasing the number of years to depreciate their servers. Means the depreciation costs for servers is spread over more years. Capital intensity is going up in that case despite all of Amazon’s efforts to increase their capital efficiency such as in house CPUs, Nitro networking cards, AI accelerators, and in house SSD controllers.

We are increasing the useful life for servers from 4 years to 5 years and network equipment from 5 years to 6 years. As a result, our first quarter guidance includes an approximate $1 billion of lower depreciation expense.

Total capex at $35.0 billion in 2020, $55.4 billion in 2021, and 2022 is going up without a doubt.

Unearned revenue primarily relates to prepayments of AWS services and Amazon Prime memberships. Our total unearned revenue as of December 31, 2020 was $11.6billion, of which $9.3 billion was recognized as revenue during the year ended December 31, 2021 and our total unearned revenue as of December 31, 2021 was $14.0billion

For contracts with original terms that exceed one year, those commitments not yet recognized were $80.4 billion as of December 31, 2021. The weighted average remaining life of our long-term contracts is 3.8 years.

That backlog!

GlobalFoundries

To start off with the big guns, GFS beat, raised, and guided capex to be up more than 2x year over year!

The $4.5B capex guide is pretty wild! They are spending more than 2/3’s their 2021 revenue on 2022 capex. This is entirely funded by prepayments. GlobalFoundries says that the long term for capital spending as a capital as percentage of sales is 20%.

All of our expansion investments are backed with customer long-term capacity reservation agreements and significant prepayments. Further, the majority of this expansion investment is in support of single-source business.

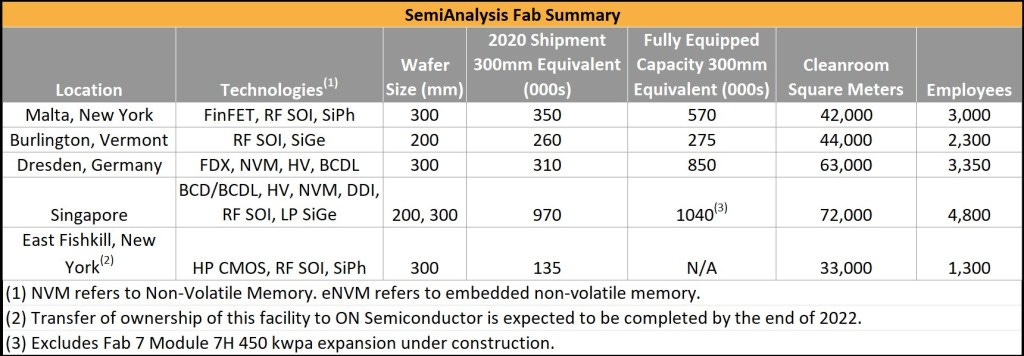

The single sourcing of business is a major point. We wrote up GlobalFoundries technology moats in the past, but they are really starting to come to fruition across RF SOI, specialty CMOS processes, FDX, SiGe BiCMOS, GaN on Si, and Silicon Photonics. Qualcomm, Qorvo, SkyWorks, Murata, MediaTek, and Cirrus Logic have all given GlobalFoundries long term agreements and prepayments for future capacity.

GlobalFoundries will be growing capacity in Malta, Dresden, and Singapore by more than 50% by 2023 versus 2020.

GlobalFoundries secured many long-term contracts with prepayments. Along side these terms, they also expect for ASPs to rise 10% year over year in 2022 versus 2021. The industry is structurally higher cost due to changes like these being inked in for the long term across many parts of the supply chain.

In addition, we established ourselves as the industry leader in silicon photonics. Our monolithic and hybrid solution garnered over $500 million in new design wins in the year. And silicon photonics revenue almost tripled in 2021 and we expect it to more than double again in 2022.

While most of this expansion is not related to silicon photonics, it is one area that we like to keep informing people about.

Ford

This quote is amazing

Thank you for your question. Perhaps the biggest gift for all the pain we're going through now in semiconductors is that we have very painfully learned the lesson that we cannot manage the supply chain for these key components as we have. In fact, you could argue that in the change of transition to these digital electric vehicles that supply chain could be one of the biggest advantages a particular company has or doesn't have.

The way we look at it is the key electric components, memory chips, semiconductors. I would break semiconductors into 2 types. I'll come back with GlobalFoundries in a second. Feature-rich chips that we still use a lot. A window regulator doesn't need to have a 4-nanometer chip. And the advance -- but we also have sensors, power electronics for our inverters, the batteries themselves all the way back to the mine, the inverters of different battery. Chemistries itself have different raw materials and kind of ecosystems that support them. So this is a very important topic for the company.

How different it is? It's really different. We need different talent at the company. We need physical inspection of the actual producers. We need direct contracts with them. We need to design the SoC ourselves. We need to direct in the case -- in some cases, to even direct prefer build to print or actually use supplier XYZ to get out of where we've been. And this takes talent. It takes a different approach. It takes more resources.

On GlobalFoundries, it's kind of the first big bet, but there'll be many, many more coming for us. We're very dependent on TSMC for our feature-rich nodes. Obviously, the capacity is at risk over time as the industry moves to more advanced nodes, including us. And as I said, we're going to need feature-rich nodes for many years to come. GlobalFoundries knows how to build them. They know to build them in the United States. We can partner with the government, depending on the CHIPS Act to capacitize here. It will be a few years until we benefit from that, but it's a really big thing to descale ourselves on the feature-rich chips from the current ecosystem that we depend on around the world. And I think GlobalFoundries is a really interesting deal when we get into the details.

We have to put cash up when we participate. Those feature-rich semis will be used by other companies, industrial companies, not just Ford. It's a really interesting deal. And I was talking to the U.S. company. You can expect the same kind of thing on advanced nodes and all the other components I mentioned, including more deals on the raw material for various types of battery chemistry. And this is a culture change at Ford. As I said, this is part of the rhythm change between ICE and BEV.

Did the auto company that fared the worst from shortages just pivot the hardest towards semiconductors? Some of it is empty signaling because of how poorly Ford has been doing under current shortages, but some of it is also a culture shift at the firm.

Did you guys notice the Ford and GlobalFoundries deal is non-binding?

In other words, completely PR!

Kulicke and Soffa Industries

We were a bit bearish on the order book last post, and for good reason. As expected, order book did go down, but order book did not go down as much as we expected and overall, it was still decent. With that said, this quarter’s order book was the wall of worry for us, but it is even more worrisome for next quarter.

Honestly, we are flabbergasted the China issues did not impact them more. KLIC revenue still outpaces their orders in the quarter by a bit, but even ignoring the huge backlog, the valuation is cheap at the number of orders in quarter level. What’s scary is the guidance and commentary on the call makes it seem like the next quarter orders will be down a decent bit and possibly under $300M.

We predicted $7 EPS in 2022 which was well above consensus. This quarter is good progress on that number. Gross margins and operating margins crept up despite a slightly smaller revenue number, which shows operationally, they are digesting the huge growth well. Our $7 EPS contemplates the massive ~24% of market cap that is sitting in cash and short-term investments. We expected $400M of this would be deployed for buybacks in Q2 and Q3, but that isn’t the case. It is looking more like $300M will be used, with most coming in Q3 and Q4.

The traditional wire bonder orders do shrink in 2022, but the incoming business from TCB for Intel’s co-packaged optics, battery and automotive, and miniLED will make up for the slack. With

And because we are so humble, here is the response to our question from the earnings call about the relationship between front end and back-end spending.

Semi unit growth was around 20% in calendar year '21. So front-end investment continue to flood through front end. Yes, that's true. But normally, I think it will take a year, sometimes 2 years, depending on what kind of technology and investment scale to reach.

For example, investment from 2 years ago in China are expected to support wafer capacity growth in the second half calendar year, right? So I don't know if I answer your question. So normally, I think it takes up probably -- it can take up to 2 years.

None of the 2021 or 2022 front end capex has flowed through to backend orders. We are still bullish once we get through this air pocket. The stock probably doesn’t do too much until we get through Q2.

I also asked about the battery business. This is one that I am very bullish on KLIC about. With the over $30B in battery facilities for EVs announced, the pack construction is an incredible opportunity.

Q: For a follow-up, I wanted to ask a bit more about the battery business. At the Investor Day, you talked about a laser-based cylindrical bonder system, but we didn't really get much information beyond that. There's a lot of competition in the heavy wire bonder space for automotive. But what is this laser system? What is the advantage here? What does that do for competition?

Okay. So historically, I think we live in the heavy wire wedge space within automotive, right? But right now, actually, we have a battery solution, 2 for cylindrical and 1 for prismatic. So let me get into a right point why people think about laser compared to wedge. I think laser has a much faster process. The laser, the cost of ownership is low. But it hasn't demonstrated high-volume production capability yet.

One of the biggest issue, I think the process window tends to be narrow. And if a process window shift a little bit it can lead to some reliability concern, right? But some people actually -- I don't even know the term, pack assembly. So nobody, I think these days people use for -- tend to -- try to use a pack assembly, and it does provide an alternative process for some customers.

Fusen isn’t a native English speaker, and he is clearly more of a technical guy, so don’t fault the transcription service I used here too much. The point is they have heavy bonders for cylindrical and prismatic battery cells as well as a new laser system for automotive. We believe the customer for this new system is LG. Tesla by the way, has been a top 10 customer for KLIC as well. They are getting wins at CATL, Panasonic, and BYD aswell.

FormFactor

Typical quarter for them, they executed on exactly what they said and guided okay growth. Given the nature of the business, it’s a stead slow compounder. This business isn’t cyclical like wafer fab equipment or other consumables. We are excited for the Technoprobe IPO in Italy which should happen this month. Look forward to an in-depth post from breaking down the IPO and competitive positioning.

Their mix is improving measurably with more going to foundry and logic customers. The DRAM, RF component continues to steadily decrease as a percentage of total share which is great. Form is #1 in market share for DRAM, NAND, and RF, and this isn’t changing, but it’s good they have such a diversified business while also capitalizing on the strength in logic.

There were decent progress updates on the engineered systems, probe systems, probe, FRT lab metrology tools, and quantum, but these will remain niche relative to probe cards.

But if you look out a little bit further to heterogeneous integration, chiplet strategies or tile strategies, those definitely are raising test intensity, which is going to require more of probe cards per wafer out. Now that for us, right now, is a very significant R&D activity, but I wouldn't expect it to significantly help with revenue until maybe late in this year or early into 2023.

Texas Instruments

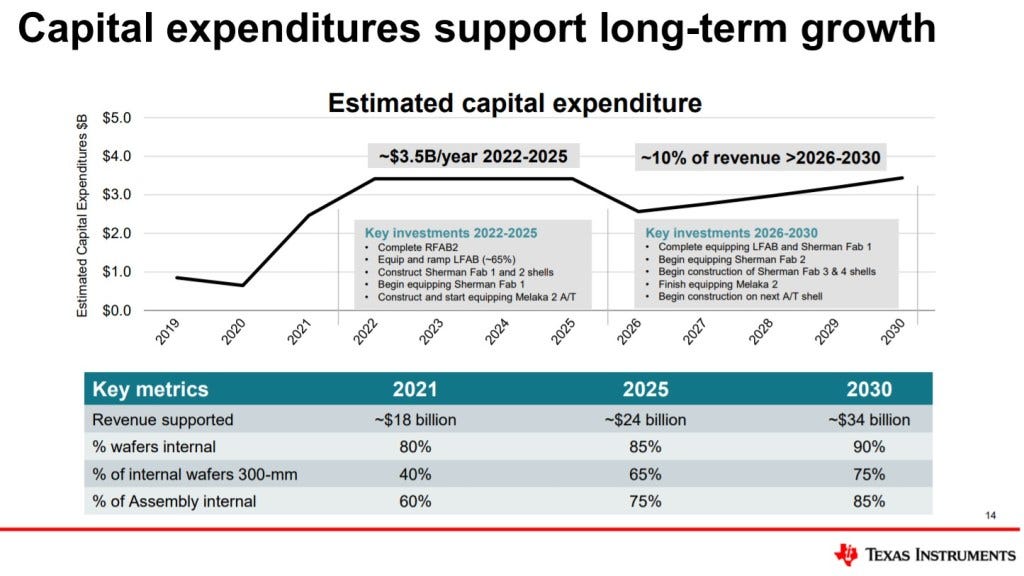

The capital management day was nice, we recommend you check it out. The one thing we wanted to point out was that the movement in the stock because of the capital management day was braindead. Here is a company who is saying we are going to invest in ourselves to keep growing, and we will continue to return most of our cash to shareholders via dividend and buyback, and the stock goes down. The reason it went down was squarely this slide, which is ridiculous. Investing in growth is good. Internal manufacturing is a margins booster as long as you are utilized and given how analog works, they will be utilized.

Power Integrations

The GaN announcements continue to rack up here. Technologically, we believe they are better than Navitas Semiconductor. They have better share, more efficient ICs, and better relationships through the industry. They are the highest volume company in GaN. While many other players are in the consumer GaN world, we believe that POWI is most likely to be able to extend it up to the industrial side.

Our unique foundry model and timely investments in capacity, which enabled us to win market share in 2021, will help us again in 2022 as lead times remain stretched across the industry.

Our own numbers agree with this statement in the subsectors they operate in. Don’t underestimate their quality. A bit expensive, but paying up for quality is a reasonable strategy for long term performance.

We expect to double our addressable market to more than $8 billion over the next 5 years with the expansion primarily coming from the appliance, industrial and automotive markets.

Their commentary on automotive wins is huge. We haven’t been able to confirm where the SiC IC is fabbed, but we believe it is at XFAB. The important bit is how POWI is using their module level expertise and sales/support channels to score wins.

This latest InnoSwitch device designed for next-generation 800-volt EV platforms, incorporates a 1,700-volt silicon carbide MOSFET. The challenges of high voltage are new to the automotive market and customers are eager to tap our expertise. As noted earlier, we have multiple automotive design wins going into production later this year, including an emergency power supply for a Tier 1 automotive supplier. We have additional designs scheduled for production in 2023 and 2024, and a strong pipeline of design activity involving 7 of the world's top 11 automakers.

Debt free, great cash generation, and a sound capital allocation policy.

We took advantage of market volatility, including the turbulence around our promotion to the S&P MidCap Index to buy back 2% of our outstanding shares between November and January.

This one is a bit worrying though.

Our unique foundry model and our investments in back-end capacity have enabled us to build inventories back to 114 days at year-end, up 15 days from the prior quarter and within sight of our target level of 125 days.

15% YoY growth combined with inventory growth is a bit scary. It is somewhat understandable though because they sold down a ton of inventory in Q4 2020. Still, not exactly confidence inspiring. The guide is for 4% YoY growth, so expect that inventory to continue to build to the target level of 125 days. This guide has some China impact in it, but we aren’t making excuses for POWI.

We might even suggest to some to put a short on it, but the company is really good, and will reaccelerate in the second half, so you could very likely would get burned.

Sumco and GlobalWafers

Sumco is completely booked for 4 years. Just nuts!

Demand for 300 mm wafers for both logic and memory use is expected to continue growing, with the entire volume including the increases from new facilities to be covered by long term contracts through fiscal 2026.

GlobalWafers likewise, failed in their $5B buyout of Siltronic. As a result, they just announced plans to spend $3.6B on new capacity, with $2 billion for a new plant slated to open in 2024 and $1.6B to upgrade existing plants.

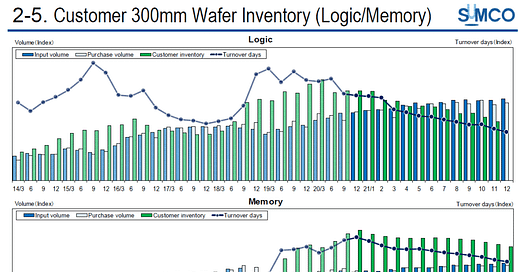

This chart from Sumco is amazing. Inventories for logic and memory are crunching, and turnover for existing raw wafer supplies is falling. The difference in logic inventories is much larger. Unfortunately the lack of Y axis prevents us from knowing what days of inventory are like, but some fabs could start hitting bumps for capacity of raw wafers. This trend doesn’t sound like it will reverse anytime soon. Easy to see why the major fabs of the world rushed to buy up all the capacity and likely are doing the same with GlobalWafers.

Sumco had some very interesting charts for projections into the future aswell. Given they say they are booked through 2026, their numbers for 2022-2025 are likely going to be very accurate one would assume.

A bit surprising, they see DRAM wafer volumes continuing to grow 10% a year, but to keep bit growth going, it has to be done. If so, given the lack of scaling, we should expect some new greenfield announcements out of Samsung, SKHynix, and Micron this year. All 3 are really running out of clean room space on the DRAM front. With the head of Samsung out of jail, we expect Samsung to announce some gnarly announcement this year in regard to memory and logic capex. Something that could make TSMC’s $40B-$44B gauntlet seem like a bit of a meme.

Also the fact they see smartphone units continuing to grow is pretty wild. Our view is that it stays flat at 1.4B volumes with the only increment being content growth. Phone lifetimes are extending after all. Perhaps Sumco is misattributing some Logic, NAND, and DRAM that is going into servers as going into mobile. Or perhaps we are wrong…

With the capital spending and lack of new capacity over the next couple years, everything looks great for the substrate guys. Be wary of what China substrate guys are doing because they could crash this whole market. GlobalWafers looks especially vulnerable due to their increased spending on capex and attempts to enter the compound semi substrate markets.

If raw wafer growth is 10.2%, MSI growth is likely similar if not slightly higher with some capacity transitioning from smaller wafers to larger. This screams long a certain company which we will mention behind the subscriber wall.

Also behind the subscriber wall, we want to discuss Ichor. We pointed out issues at this firm earlier this earnings season behind the subscriber paywall. They were reason for Lam Research missing heavily, and our suspicions about them ended up being correct based on the earnings release. There are further implications in the supply chain that could cause another semicap firm to miss as well.

In addition, we also discuss a small bit from Skyworks, Qorvo, Qualcomm, and Murata. There is also a take we have on Rambus and Renesas as well. Even if you aren’t interested in any of these firms, it would be great if you could support us! We will be getting back to the deeper dives on the technology with upcoming articles on Hybrid Bonding, Masks, and Silicon Carbide. They should be deeper than anything else out there publicly available and take a lot of time to research and write.